Cost of Business Insurance in Mississippi

Every company is different, so the cost for coverage will vary significantly from one business to the next. Rates can be influenced by a number of factors such as your company’s size, industry, and liability risks; the number of workers you employ; the value of the assets you wish to insure; and the coverage types you wish to include in your policy. Independent insurance agents can help you understand your many options and can obtain a selection of customized quotes. That way, you can be sure you are getting suitable coverage at a competitive rate.

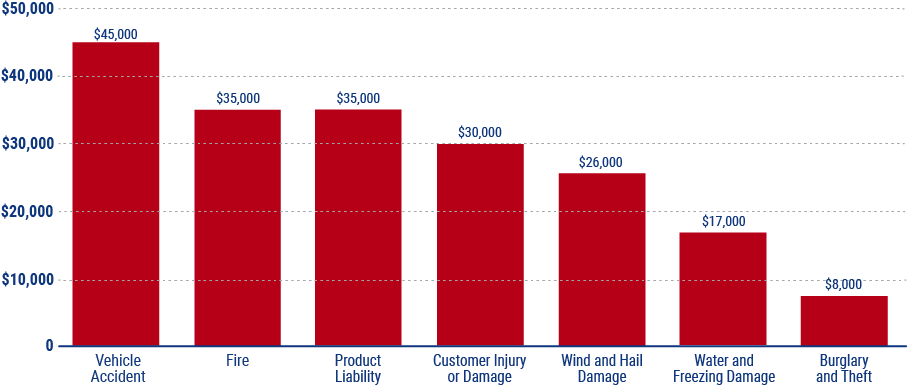

Average Cost for the Top Business Insurance Claims