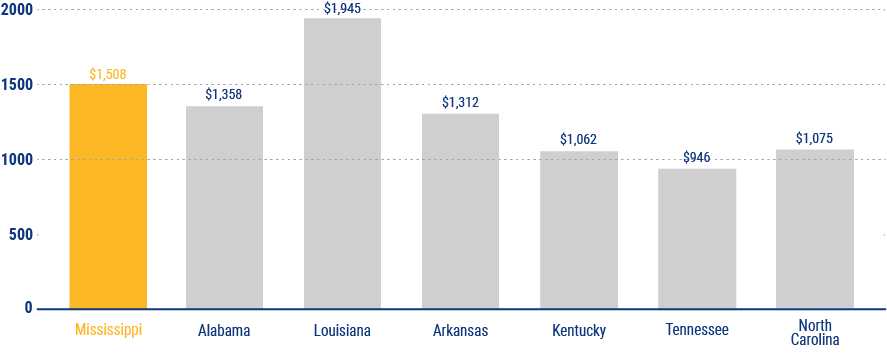

Average Cost of Home Insurance in Mississippi

On average, Americans pay $1,173 a year for their homeowners insurance. In Mississippi, rates are significantly higher with an average cost of $1,508, making this the 6th most expensive state for home insurance coverage. Your costs may be influenced by the home's size, age, value, and building materials, the crime rate and weather risks in your ZIP code, and even your credit score. Shopping around for the best rate has the potential to save you hundreds of dollars a year, and independent insurance agents make comparison shopping easy.

Average Cost of Home Insurance in MS