If you own a little piece of land or a big one, you're already living the American dream. The right coverage for your operations is necessary to avoid financial ruin or worse. Mississippi business insurance will have protection for your farm if you know which companies are the best.

Fortunately, a Mississippi independent insurance agent has your ticket to better coverage for a fraction of the price. They'll do the shopping for free so that you can relax. Connect with a local expert for tailored quotes in minutes.

What Is Farm Insurance?

Your Mississippi farm should have coverage for all aspects of your operation. Whether you're in the crop business or run cattle, the proper policies are necessary. Take a look at farm insurance to consider:

- Farm insurance: Several insurance policies could fall under farm coverage. Liability, property, equipment, crop, livestock, and homeowners are the typical options you'll be met with when deciding on coverage.

The Best Farm Insurance Companies in Mississippi

The best is relative when it comes to anything. However, you can determine which companies are the most popular and used by many. This should give you an idea of the carriers that your peers trust.

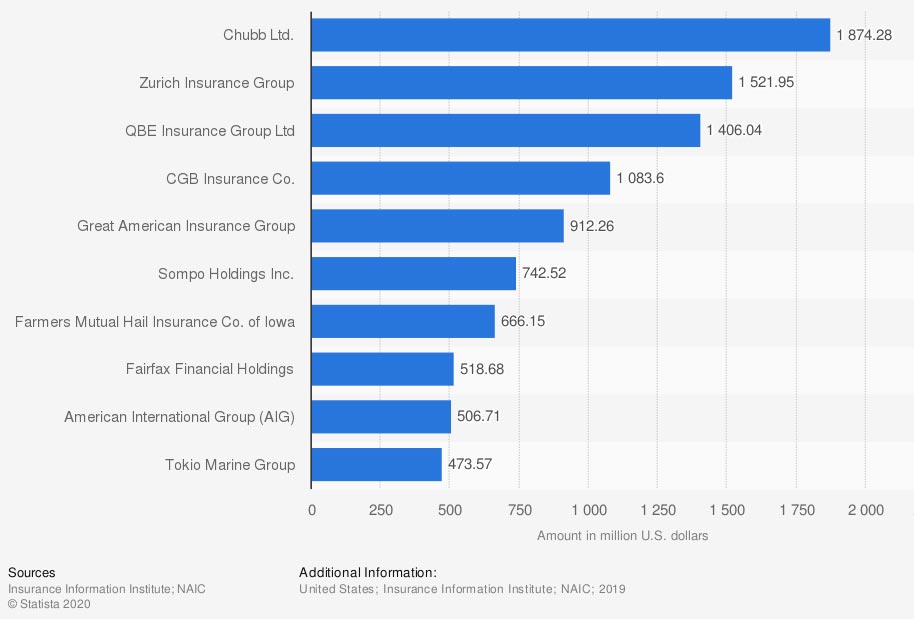

Largest multiple peril crop insurance companies in the US, by direct premiums written

You can't say a carrier is the best just because they bring in the most premium. But you can see where people place their money, which usually speaks volumes about the better option for farm insurance.

How Much Does Farm Insurance Cost in Mississippi?

In Mississippi, the value of crop-hail insurance is $81,300,000. Carriers use multiple risk factors when deciding your farm insurance premiums. Most of your farm policies will fall under a private carrier, including crop-hail insurance. Check out what goes into your costs:

- Prior losses

- Value of farm equipment and property

- Value of crops

- Your age and experience

- Length of time with the previous carrier

- Local crime rate

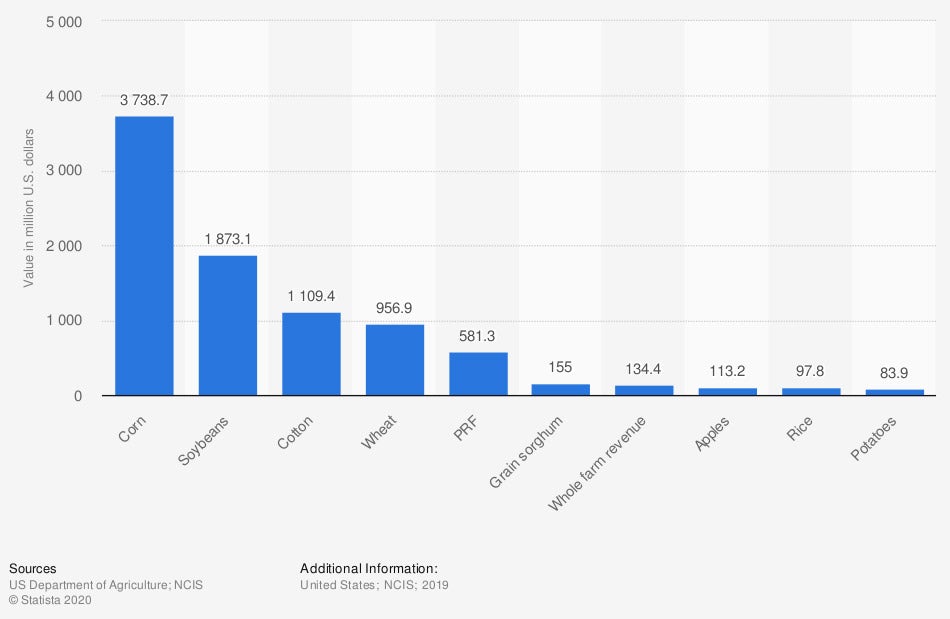

Value of crop insurance premiums in the US, by crop

Multiple peril crop insurance is your primary crop policy and one that is backed by the federal government. This coverage will be insured under their crop program and separate from crop-hail and other commercial policies for your Mississippi farm.

What Do Farm Insurance Companies Offer in Mississippi?

Mississippi farms will come with many rewards, and they'll need a substantial amount of protection. Each farmer will have options when it comes to policies. Take a look at standard coverages to consider for your farm:

- Liability: A general liability policy will provide bodily injury and property damage coverage.

- Commercial property: This policy covers your farm structures and pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

- Crops: There are a couple of different crop policies you can obtain. All will cover various types of damage to your crops and provide reimbursement for the value if necessary.

When Is the Best Time to Buy Farm Insurance in Mississippi?

The best time to obtain coverage for your farm is as soon as you own it. Protection for your home, acreage, crops, equipment, and more should be the first task on your list. To get started, your adviser will need to know some of the following information:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs from cattle and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk of the replacement cost if something happened to them.

- If you have crops: If your farm deals with planting and producing crops, you'll need separate crop insurance.

- Other structures and buildings: If you have a home, pole barns, and more on your property, you'll need coverage for the buildings themselves.

- What preemptive protection you have in place: Carriers will want to know how you are proactive, such as if you are accounting for the risk of predators by having fencing and more.

How a Mississippi Independent Insurance Agent Can Help

In Mississippi, your farm is your livelihood. To avoid bankruptcy, you need to protect it just like a business because it is. Fortunately, a licensed professional can help review and shop your policies for free.

A Mississippi independent insurance agent has access to a network of carrier options, giving you a leg up on coverage. They'll compare your risk factors with numerous highly rated companies and present you with the best. Connect with a local expert on trustedchoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.