No matter where you live, you'll need proper coverage to use the roadways safely. There are several policy options when it comes to insuring your vehicle that can make coverage confusing. Mississippi car insurance can be calculated to fit your budget and needs.

A Mississippi independent insurance agent can help you find an affordable policy through their network of carriers. They'll do the shopping for free, making it a no-brainer. Connect with a local expert for custom quotes to get started.

What Is a Car Insurance Premium?

The price tag associated with your car insurance policy can give you sticker shock if you're not using a professional. Take a look at how your car insurance premium works Mississippi:

- Car insurance premium: The cost to obtain state-required car insurance. This can include the price to cover liability, property damage, and uninsured motorists under your auto insurance policy.

How Much Does the Average Car Insurance Premium Cost in Mississippi?

It's good to know what the typical cost to obtain coverage is in your state. Mississippi has a higher car insurance rate than the national average, making it vital to find an affordable policy.

- National average cost of car insurance: $1,311

- Mississippi average cost of car insurance: $1,584

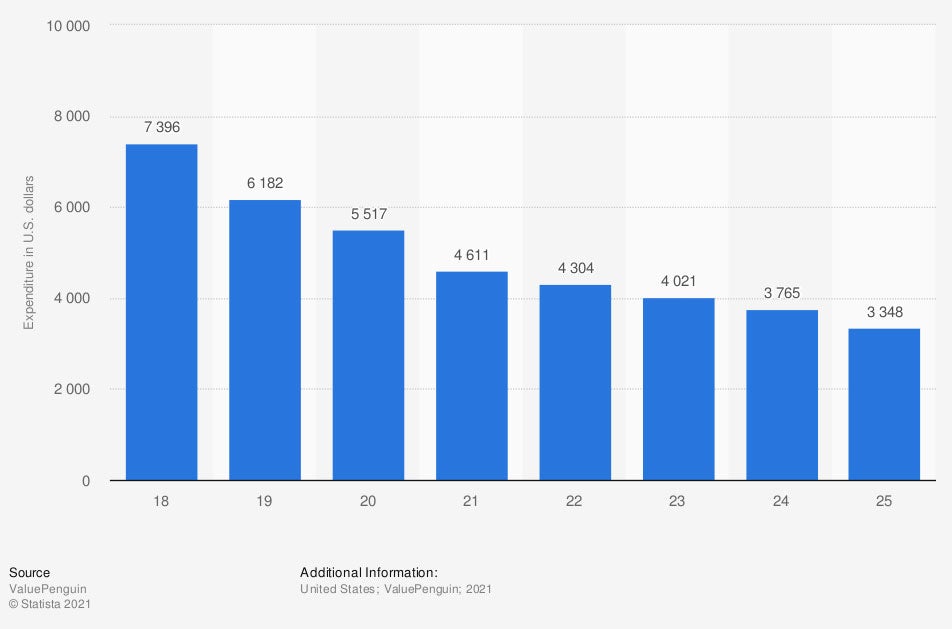

Average auto insurance expenditure in the US in the last year, by age (in US dollars)

Your exact costs for a car insurance policy will be specific to your needs and vehicles. To find out how much your bill is, you'll need to obtain custom quotes.

How Are Car Insurance Premiums Calculated in Mississippi?

In Mississippi, there has been $414,262 in auto insurance losses in one year alone. Carriers look at that and several other risk factors when calculating your car insurance premiums. Check out what goes into your costs:

- Prior losses

- Value and type of vehicle

- Motor vehicle reports of all drivers

- Your age and experience

- Length of time with the previous carrier

- Local crime rate

The insurance companies take the above factors and use them to determine the type of risk you are. This is the basis for their rates, and they use it for every driver, making pricing unique.

What Types of Vehicles Receive the Lowest and Highest Rates in Mississippi?

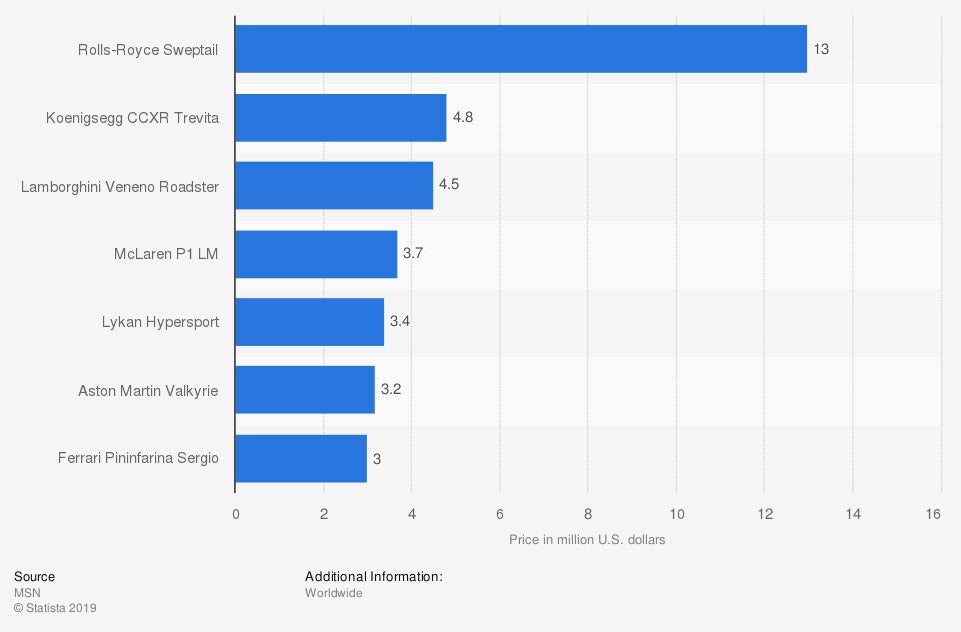

Mississippi auto insurance rates are impacted by the types of vehicles you drive and their values. If you have a teenage driver, you probably don't want their first vehicle to be a sports car. Mixing new drivers with expensive cars can make your insurance costs go through the roof.

Most expensive cars available worldwide ranked by price (in million US dollars)

While you may not be strutting around in a Rolls-Royce, your vehicle selection can have a lot to do with your insurance. The more it costs to replace your car, the higher your premiums. To get a lower rate, you'll want a vehicle with a high safety rating and a low value.

Can I Calculate My Mississippi Car Insurance Rates Myself?

The short answer is no. You'll have to run your auto insurance through a carrier. While you can't calculate your own car insurance, you can find a trusted adviser who can help. They will use several rating factors to determine your costs and how much coverage you'll need.

How a Mississippi Independent Insurance Agent Can Help

Your Mississippi car insurance can be challenging to calculate if you're not a licensed professional. Multiple coverage options could dictate your pricing. If you're trying to stay within a budget, then you'll want to consider getting someone who can help.

Fortunately, a Mississippi independent insurance agent has access to a network of markets. This gives you the best options to suit your budget, making it easy. Connect with a local expert on TrustedChoice.com for free quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/555827/auto-insurance-costs-usa-by-age/

https://www.statista.com/statistics/277957/most-expensive-cars-worldwide/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.