Nowadays, everything is digital and online, which can be really convenient until it's not. When you store all of your vital information in one area, it is easier for a thief to steal. Fortunately, a Mississippi business and homeowners policy can help with identity theft protection.

A Mississippi independent insurance agent will review your policies for gaps in coverage. Then, they'll quote your insurance through their network of carriers for free. Connect with a local expert to start saving in minutes.

What Is Identity Theft?

Identity theft is a common occurrence in today's market. It's now easier than ever to steal someone's identity and completely demolish their life as they knew it.

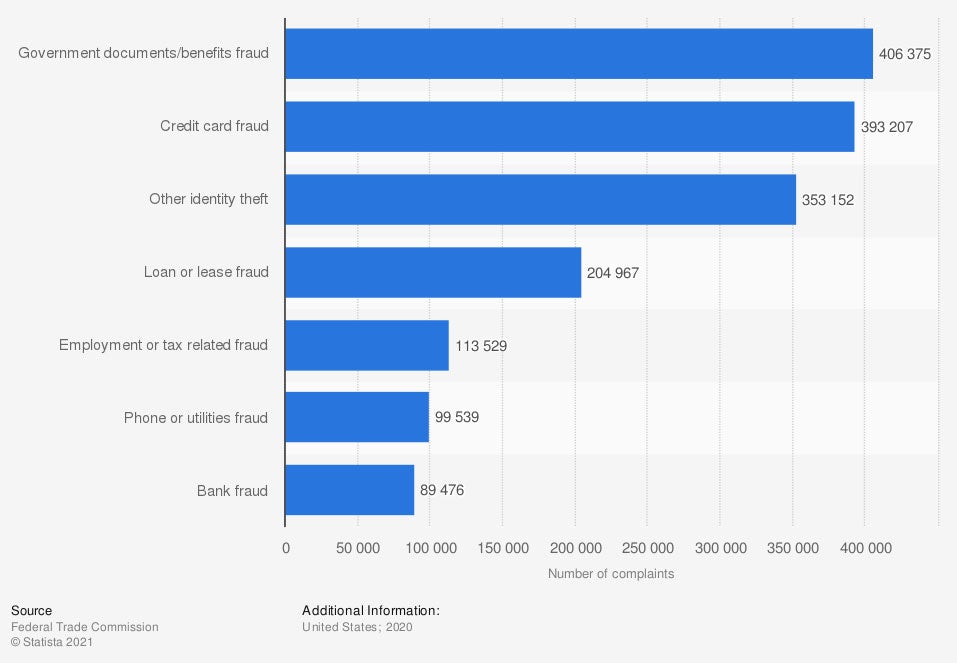

Number of identity theft complaints in the US last year, by nature of crime

Make no mistake, identity theft is a serious crime that can take months and even years to straighten out. Once a crook has your sensitive data, everything you own is compromised.

What Is Identity Theft Insurance?

Identity theft insurance comes in many forms. It can be on your primary homeowners policy or your commercial insurance coverage. It will also depend on who you're protecting to determine where it gets applied.

With commercial insurance, you could have a couple of policies with identity theft built in for different claims instances, while with a homeowners policy, there's usually just one. To understand where and how much identity theft coverage you'll be needing, consider speaking with your adviser.

Do I Need Identity Theft Protection?

Every person and business will need to protect their identities from online thieves. These pirates of the digital age will stop at nothing to steal your information and bleed your bank accounts dry.

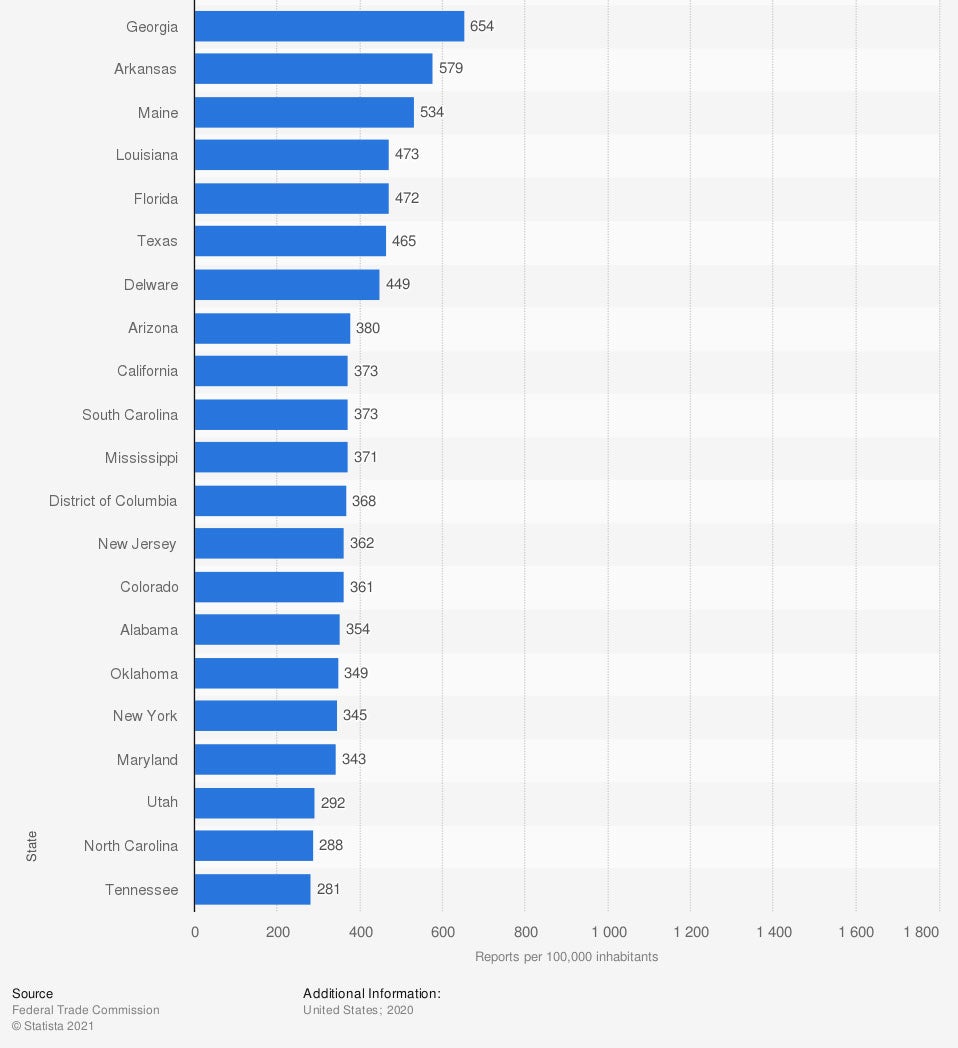

Rate of identity theft reports in the US last year, by state (per 100,000 population)

Identity theft occurs on a daily basis. In Mississippi, you can be prepared to avoid any unnecessary hacks with the right tools.

What Can I Do to Prevent Identity Theft in Mississippi?

While you can't know what's around every corner, you can prepare for the worst. Some critical steps to avoid your sensitive data being stolen in Mississippi are listed below:

- Hire an IT company: This will help set your business and personal life up for success. An IT company can quickly prepare your computer systems for an attack before it occurs, thwarting off predators.

- Use anti-virus software: If your personal or business computer doesn't have anti-virus software to protect your system from online scammers, then you could be exposed.

- Look out for phishing emails: If you know what a phishing email looks like, you won't be tempted to compromise your sensitive information.

Are My Employees at Risk for Identity Theft in Mississippi?

As a business owner, you're responsible for the well-being of your company and your staff. If your system gets hacked and sensitive employee data is stolen, it'll be your company on the line.

Cyber liability insurance can help you pay for any expense that arises out of stolen information. To avoid a scam before it starts, it's good practice to have safety measures in place ahead of time. A trained adviser can help you prepare for all the what-ifs.

How a Mississippi Independent Insurance Agent Can Help

The right protection can mean the difference between you paying for a loss out-of-pocket or the carrier covering the loss. The expense of getting your identity stolen is high and not one you want to go at alone. Fortunately, a trusted adviser can review your policies and help you stay proactive.

A Mississippi independent insurance agent will do the shopping for you at no additional cost. This ensures that you get the best coverage for a fair price and avoid missing out on key limits. Connect with a local expert on TrusteChoice.com to get started.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/194017/identity-theft-complaints-in-the-us-by-nature-of-crime/

https://www.statista.com/statistics/302370/rate-of-identity-theft-reports-in-the-us/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.