If you're a licensed driver, then you know how important it is to have protection from all the what-ifs. Whether taking to the roads is for fun or just a means to travel to a location, you'll want to be insured. Mississippi car insurance can help cover a loss that involves hitting a deer.

Coverage for a claim can be confusing, but a Mississippi independent insurance agent can help. They'll review your policy for free, ensuring that you have everything you need to use the streets. Connect with a local expert for custom quotes in minutes.

What Is Car Insurance?

When you strike a deer on the road, it can disorient you and any passengers. If you have the proper coverage in place, you won't have to worry about who's responsible for the bill. To obtain the right protection, take a look at how car insurance can help:

- Car insurance: This policy comes with many coverage options and protects against a lawsuit arising from bodily injury, property damage, or physical damage.

What Does Car Insurance Cover in Mississippi?

Your Mississippi car insurance comes with numerous options for coverage. Most states have a minimum liability limit requirement, and Mississippi is no different:

- Minimum limits of auto liability in Mississippi: $25,000 per person/ $50,000 per accident/ $25,000 property damage

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

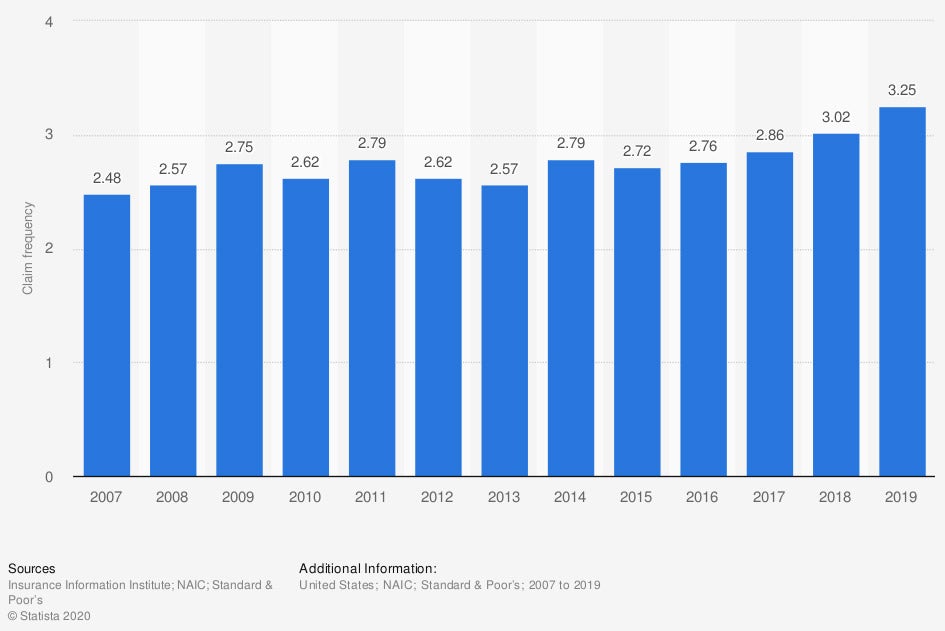

Frequency of private passenger comprehensive auto insurance claims in the US in recent years

At the rate of car accidents, you'll need coverage for hitting a deer and more. It's vital to understand what your auto policy protects against and what it doesn't.

What Doesn't Car Insurance Cover in Mississippi?

The annual average cost of car insurance in Mississippi is $1,584, which is less expensive than a significant loss. Your auto policy will not automatically come with coverage for all your needs. If you want protection for anything other than liability, you'll have to add it.

Optional car insurance coverages:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction.

- Collision coverage: Pays for property damage to your car in the event of a crash.

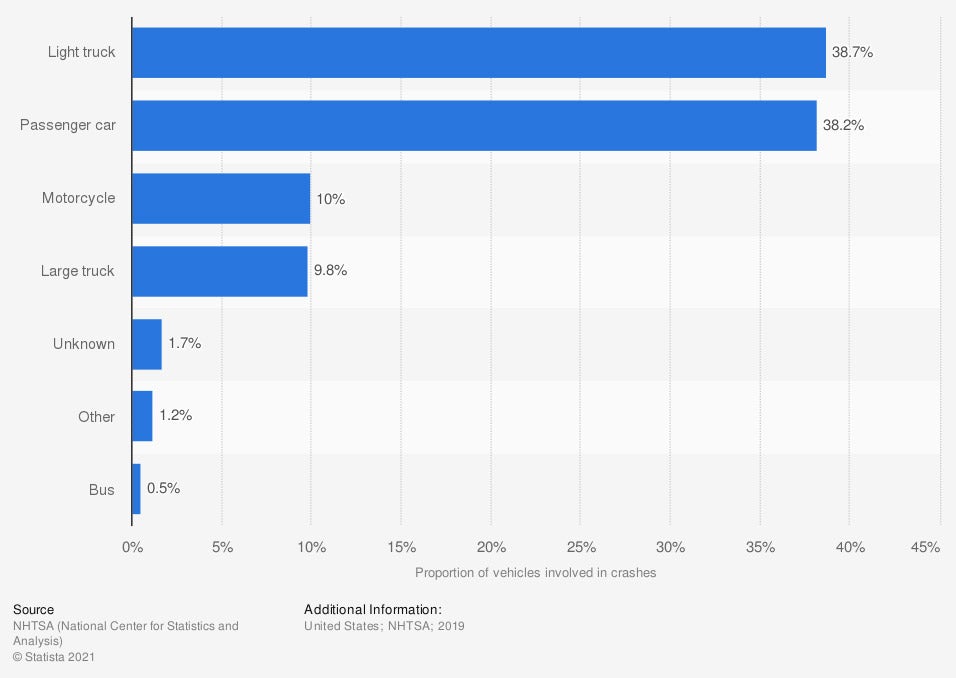

Distribution of vehicles involved in fatal traffic crashes in the US in one recent year

A car accident can turn fatal in a matter of seconds. While you can't predict the future, you can be proactive.

Does Car Insurance Cover Hitting a Deer in Mississippi?

Your Mississippi car insurance will not come standard with the coverage you need when you have a loss that involves a deer. Comprehensive or collision protection is necessary to help pay for the physical damage to your vehicle. A deductible of $500 is typical for these limits, and they will need to be added to your policy ahead of time to have coverage.

How to File a Claim after Hitting a Deer in Mississippi

When an accident occurs, you may be in a state of shock. If you're unsure what to do next, follow these simple steps for filing a claim after hitting a deer in Mississippi:

- Step 1: Get to a safe place and seek medical attention if necessary.

- Step 2: Call your independent insurance agent to file a claim.

- Step 3: Obtain information from your agent about a replacement rental vehicle if needed.

- Step 4: Set up a meeting with your assigned adjuster to go over the damage to your vehicle.

How an Independent Insurance Agent Can Help in Mississippi

If you're searching for the perfect car insurance policy that fully covers you, consider using a licensed professional. It can be challenging to understand what's needed and what's just fluff. Instead, use a trained adviser at no cost so that you can relax.

A Mississippi independent insurance agent can help with coverage and premium options that fit your budget. They'll be able to review your car insurance for free, giving you the proper limits. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

https://www.statista.com/statistics/192089/vehicles-involved-in-traffic-crashes-in-the-us/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.