The right property coverage in Mississippi can mean the difference between you paying for a loss or the carrier covering it. While you can't plan for every mishap lurking around the corner, you can be prepared for it. You may be surprised to know that Mississippi homeowners insurance will not come with flood protection automatically.

Fortunately, a Mississippi independent insurance agent will have access to FEMA-approved carriers so that you can get the protection you deserve. Connect with a local expert for custom quotes in minutes. They'll even review your policies for free, ensuring there are no gaps in coverage.

What Is Flood Insurance?

Floods and other natural disasters can happen fast. To adequately insure your assets in Mississippi, several policies are necessary. Check out how flood insurance can help:

- Flood insurance: This type of property insurance covers a structure for losses due to a flood. This is caused by snow melting, storm surges, heavy rainfall, storm drainage system failures, and even levee dam system failures.

What Does Flood Insurance Cover in Mississippi?

Contrary to popular belief, your property policies do not include coverage for a flood. If you want protection from flood damage, you'll have to add it. Check out what your Mississippi flood policy will cover:

- Electrical and plumbing systems

- Furnaces and water heaters

- Appliances

- Flooring

- Detached garages

- Personal belongings

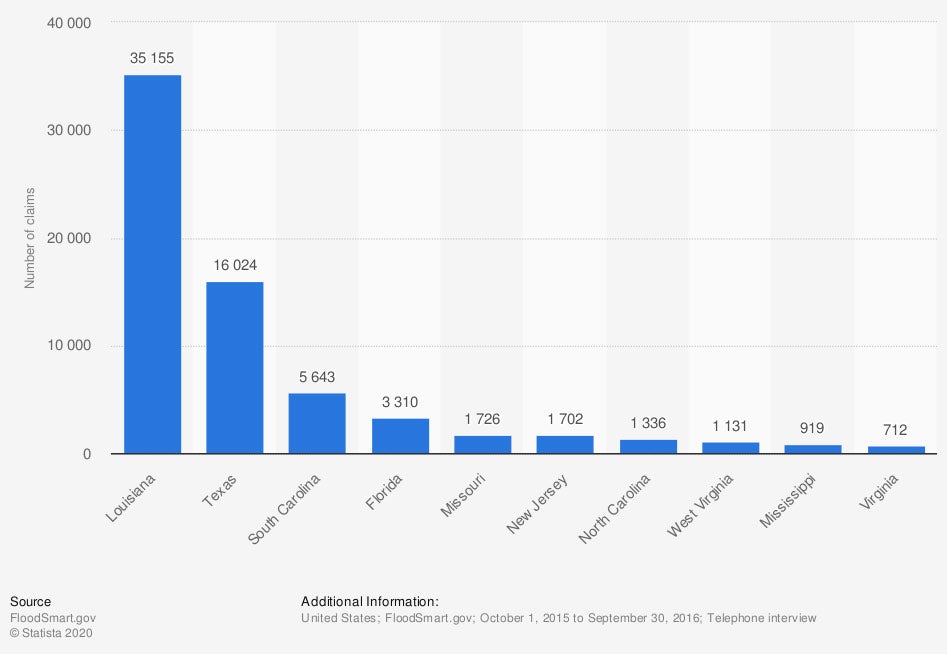

Most expensive flood disasters in the US, by National Flood Insurance Program (NFIP) payouts (in million US dollars)

A flood can occur without a moment's notice. It's imperative to have the proper protection in place before a loss happens if you want to avoid an out-of-pocket expense.

What Doesn't Flood Insurance Cover in Mississippi?

Similar to your other insurance policies, your flood insurance has exclusions. It's vital to understand what a flood is:

- What is considered a flood: A flood is an excess of water on land that is usually dry. This typically is classified as affecting two or more acres of land or two or more properties.

There are generally losses that are excluded from flood insurance, and they may fall under another primary property policy altogether. Losses occurring from water/sewer back-ups, burst pipes, waterline malfunctions, and roof leaks are usually not included.

How Much Is Flood Insurance in Mississippi?

FEMA-approved carriers will set the cost of flood insurance in your area. Your property details and risk factors will determine what you're charged for coverage. Items that may affect your Mississippi flood insurance are:

- The location of your property

- The flood zone of your property

- Whether the property is residential or commercial

- Your insurance score

- Your loss history

- Prior coverage history

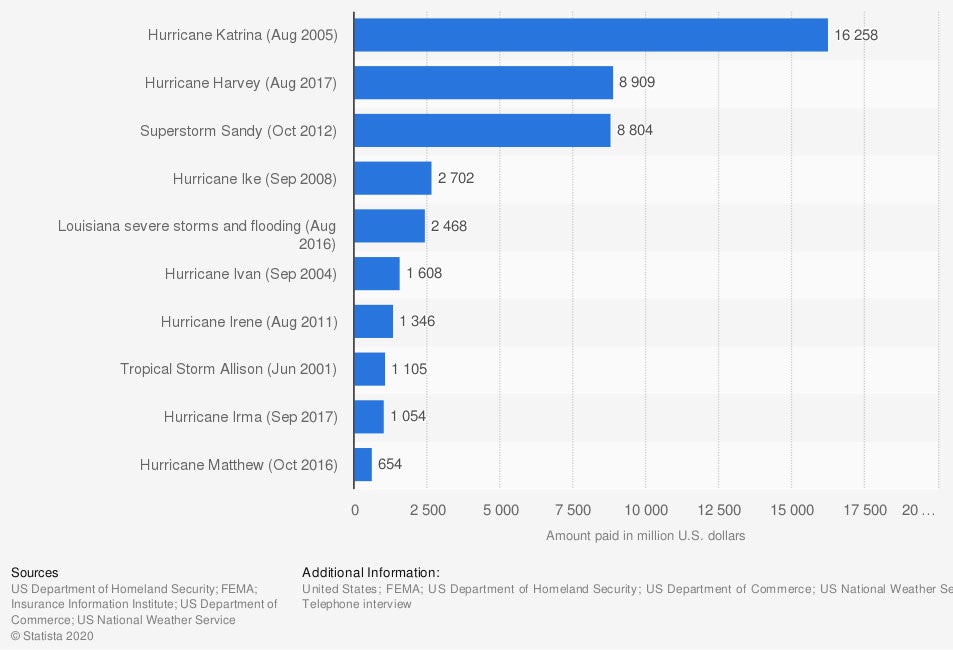

US states with the highest number of flood insurance claims in one recent year

In most scenarios, flood insurance is not required by state law or even by mortgage companies. If you're in a high-risk flood zone, your lender will mandate a flood insurance policy until the loan is paid off. Since every location can flood, coverage is always necessary.

How Much Flood Insurance Do I Need in Mississippi?

What flood zone your property is located in and the specifics of your structure will have a lot to do with the limits offered for flood protection. FEMA has maximum coverage amounts available that are determined by type and zoning. They are as follows:

- Flood insurance for your home: Flood carriers usually offer $250,000 for the building and $100,000 for the building contents.

- Flood insurance for your business: Flood carriers usually allow $500,000 for the building and $500,000 for the building contents.

- Flood insurance as a renter: Flood carriers typically offer $100,000 for contents-only coverage.

How an Independent Insurance Agent Can Help in Mississippi

If you own a property in Mississippi, you're at risk for a flood. No matter where you live, flood damage is always a possibility. It's best to be prepared with the right coverage beforehand.

A Mississippi independent insurance agent will help you find a flood insurance policy that won't break the bank. They do the shopping for free too, so that you save big time. Get connected with a local expert on TrustedChoice.com and start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/216501/most-expensive-us-flood-disasters/

https://www.statista.com/statistics/192348/top-10-us-states-for-flood-insurance-claims-2010/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.