When it comes to protecting your fortress, there are several items to consider. The value, number of belongings, and household members all get taken into account. Fortunately, Mississippi homeowners insurance doesn't have to be unaffordable.

A Mississippi independent insurance agent can review your policies at no additional cost, making it a no-brainer. They'll help you find the perfect coverage for a low price tag so that you can maximize your budget. Get connected with a local expert for tailored quotes to begin.

What Does Homeowners Insurance Cover in Mississippi?

Major losses to your Mississippi home are typically automatically covered. Things like fires, tornadoes, hail, severe weather, and lightning are included under most policies.

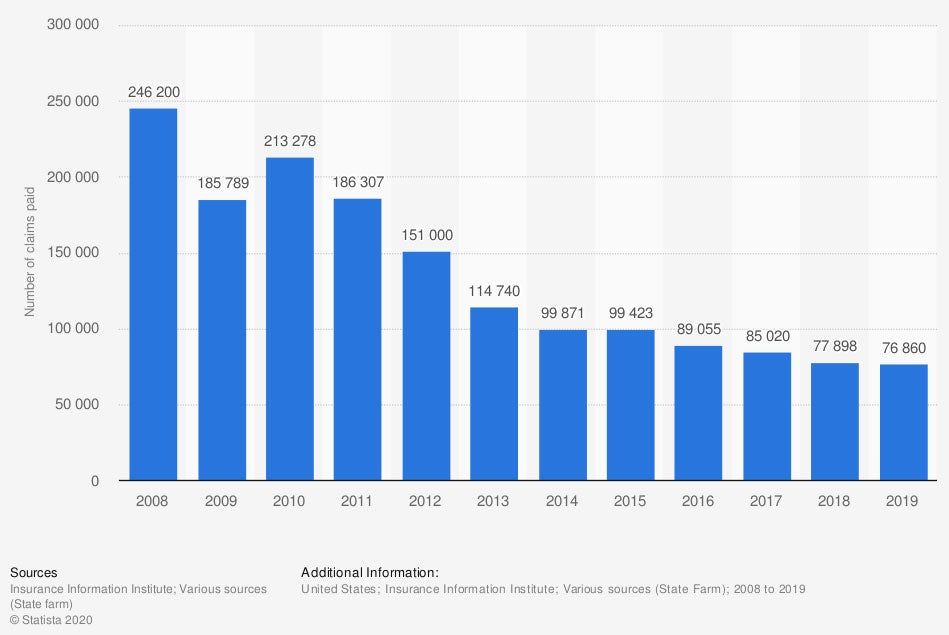

Number of homeowner insurance claims paid due to lightning losses in the US in recent years

What your home insurance covers in Mississippi:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home unlivable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

Common Disasters That Impact Your Mississippi Home Insurance

Natural disasters are unavoidable and affect your homeowners insurance. The amount of loss in your city will directly increase your insurance premiums. Check out the most common claims reported in Mississippi:

- Severe storms and lightning

- Burglary and other property crimes

- Hurricanes and tropical storms

- Tornadoes

- Flooding and water damage

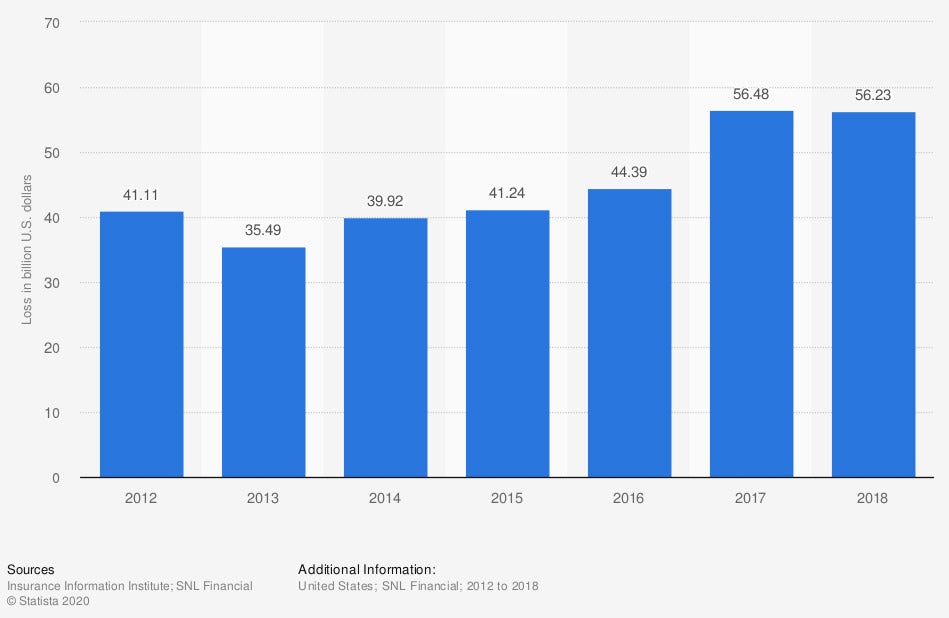

Incurred losses for homeowner insurance in the US in recent years (in billion US dollars)

An accident or loss could happen without a moment's notice. While you can't know what's lurking around every corner, you can be prepared.

How Much Does Homeowners Insurance Cost in Mississippi?

The average annual Mississippi homeowners insurance premium is $1,537. The national average is $1,211, which means Mississippi is up there on home insurance costs. To obtain exact pricing, you'll need to get custom quotes.

What carriers use when calculating your home insurance:

- Location of home

- Prior claims reported

- Value of home and belongings

- Insurance score

- Local crime rate

- Coverage selected

Optional Homeowners Coverage for Additional Protection in Mississippi

Like any personal insurance policy, there are optional coverages that you may want to consider. Some are necessary no matter what, while others depend on your specific exposures. Check out these policies for your Mississippi home:

- Flood insurance: Pays for any damage due to a flood loss on your property. Every home is at risk for a flood, making this policy necessary.

- Umbrella insurance: Provides extra liability protection when your underlying home limits are exhausted due to a larger loss. This happens more than you'd like to know. It's best to be prepared.

How an Independent Insurance Agent Can Help in Mississippi

Home insurance can be confusing when you're not sure where to start. Several policy options need to be decided upon, which can make purchasing coverage a challenge. To ensure you're not leaving critical limits of protection on the table, consider using a trained professional.

A Mississippi independent insurance agent can help you find coverage without breaking the bank. They do the shopping through their network for free, saving you time and money. Connect with a local agent on TrustedChoice.com for quick quotes and expert advice.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/217232/paid-claims-by-us-homeowners-insurers-due-to-lightning-losses/

https://www.statista.com/statistics/428998/incurred-losses-for-homeowners-insurance-usa/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.