Mississippi is no stranger to severe storms, which can leave you worried about flooding in your home. A specific area of concern is often the basement, if you have one. Typically, homes with basements are more expensive to insure in Mississippi, but why is this?

A Mississippi independent insurance agent can answer this question and others about your basement and help you find the proper homeowners insurance.

Do Mississippi Homes with Basement Flood Risks Pay More for Insurance?

In short, yes. Any home in Mississippi with a basement is likely to cost more to insure than a home without one. This is because having a basement makes the foundation of the house more complicated. The more complicated the foundation, the more it costs to insure.

Having a basement adds increased risks to your home. You have additional personal property in your home, and you run the risk of flooding. When it comes to insurance, risks and rates are tied together to calculate premiums, so the more risks you have, the more you're likely to pay.

Why Does Mississippi See More Floods?

Mississippi is ranked third in the country for the highest risk of flood throughout the state, with 23.4% of the land (11,068 mi2) in a flood hazard zone. Mississippi is prone to flooding because it sits at the bottom of the Mississippi/Atchafalaya River Basin (MARB). This basin funnels water from 41% of the US, which causes the Mississippi River and its tributaries to frequently flood.

The Mississippi River is not the only cause of flooding in the state. Heavy rainfall, snowmelt, and broken levee systems have caused flooding events.

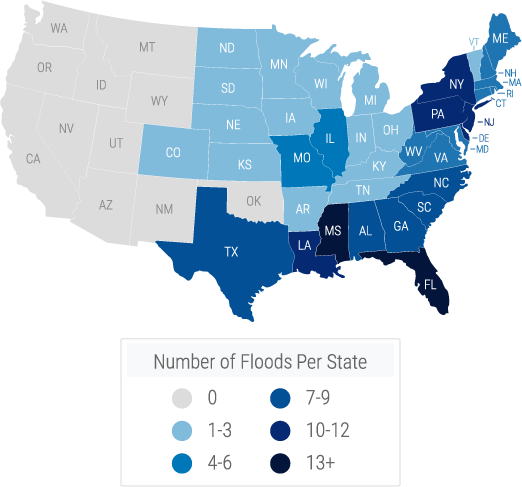

U.S. Flood Risk Map

What Does Flood Insurance Cover?

Damage from natural floodwaters is excluded in standard Mississippi homeowners insurance. In response, FEMA created a standardized flood insurance program to provide affordable flood coverage for all homeowners who needed it. The program is called the National Flood Insurance Program (NFIP).

This government-backed program partners with 23,000 communities that have created plans to mitigate flooding. As long as you live in one of these communities, you can purchase NFIP flood insurance. Through this program, you'll receive coverage for the structure of your home and the stuff inside your home.

Specifically, flood insurance covers:

- Damage to/loss of your home: This includes the home's foundation, electrical systems, indoor plumbing, built-in appliances, installed flooring, and detached structures.

- Damage to/loss of your stuff: This includes built-in furniture, freestanding furniture, personal appliances, valuable clothing, artwork, and similar possessions.

What Doesn't Flood Insurance Cover?

Since we're talking about Mississippi homes with basements, it's important to note the exclusions in flood insurance. One of the most significant exclusions is the basement. For the most part, flood damage in your basement will not be covered. Your flood insurance policy will include a specific list of what the policy covers, but this is usually limited to things like an AC, water heater, or something similar.

Flood insurance also won't cover any water damage caused by burst pipes or a leaky second-floor tub. It only covers damage from natural floodwaters.

The good news is that your Mississippi homeowners insurance will cover flood damage if it's caused by frozen burst pipes, broken appliances, leaking water heaters, or an overfilled tub, sink, etc.

Can I Be Turned Down for Flood Insurance?

Being denied flood insurance is very rare, but it can happen. There are usually two scenarios in which you'd be denied flood insurance.

- You have a history of repetitive flooding in your home.

- You're at too high of a risk of flooding.

The flood insurance program keeps track of every time a property experiences flooding. If you found yourself in a situation where you wanted flood insurance but did not qualify, it's possible you could receive coverage by elevating your home off the ground. The flood insurance program would provide you with the details and guidelines to make this happen.

How Else Can I Protect My Home from Floods?

While you can't control the weather, there are several preventive measures you can take inside and outside your home to help protect it from flood damage.

- Elevate your utilities: This includes mechanical units, furnaces, water heaters, electrical systems, and other utilities. Elevating these materials on masonry, concrete, or lumber that is 12 inches above the base flood elevation can help.

- Install tile instead of carpeting: Tiles are less likely to flood than carpet, so invest in tile or another flood-resistant flooring.

- Floodproof your basement: Since most things in your basement will not be covered, sealing the walls and installing waterproof compounds can help protect your basement.

- Install flood vents: Installing flood vents in enclosed areas such as garages and walls helps water drain.

- Consider your insulation and drywall: Installing flood-resistant insulation and drywall can minimize damage and make cleaning up after a storm easier.

- Prevent sewage back-up: Speak with your plumber about the potential of your sewage backing up if there's a flood and take necessary measures to prevent this.

- Purchase flood insurance: Make sure your flood insurance policies are in top shape with the right policies and the proper amount of coverage to cover your home.

Your Mississippi independent insurance agent can work with you on changes you can make to protect your home further.

How Much Does Flood Insurance Cost?

Flood insurance costs vary depending on multiple factors. Similar to other insurance policies, the higher your risk, the more expensive your policy.

Factors that impact flood insurance rates

- Whether your home is in a flood zone

- Claims history

- Flood history

- Amount of coverage purchased

- Elevation of your property

The largest factor in flood insurance rates is where your home is located and its risk for flooding. A home at low risk of flooding could cost around $300 to insure, while a higher risk home near the Mississippi River could be as high as $3,500 annually.

How Can I Lower My Flood Insurance Rates?

The easiest way to lower your flood insurance rates is to take the above steps to help floodproof your home. Installing safety measures and adding ways to mitigate flood damage if it occurs can help you save money on your policy.

How Can a Mississippi Independent Insurance Agent Help?

Understanding your Mississippi homeowners insurance is beneficial in knowing your coverage in certain situations, and knowing what is covered and when can be overwhelming for homeowners with a basement. Fortunately, a Mississippi independent insurance agent understands homeowners and flood insurance ins and outs.

Agents will speak with you, free of charge, before shopping for multiple insurance quotes. They'll sit down with you to walk you through your coverage options and help you secure coverage that protects your home from basement to roof.

Article Reviewed by | Paul Martin

https://mississippitoday.org/flooding-2/

https://www.fema.gov/sites/default/files/2020-11/fema_protect-your-home_flooding.pdf

https://www.epa.gov/ms-htf/mississippiatchafalaya-river-basin-marb

© 2025, Consumer Agent Portal, LLC. All rights reserved.