Mississippi's location makes it susceptible to a variety of severe weather, including storms. As a property owner, knowing what situations your insurance covers can help keep you protected. If a storm knocks your neighbor's tree into your yard, who is responsible for the damage?

To understand the ins and outs of homeowners insurance, consider starting with a Mississippi independent insurance agent. Agents can discuss financial responsibility after storm damage and answer any other insurance questions you have. But first, let's discuss whose responsible when an act of God causes you property damage.

Who’s Responsible If a Tornado Drops a Neighbor’s Tree on My Property?

When a storm comes blowing through Mississippi, you never know the damage it may cause. In the eyes of insurance, natural disasters are considered "acts of God," and even though it was your neighbor's tree that dropped into your yard, your neighbor cannot be held responsible for the damage.

There is one scenario where your neighbor may be at fault, and that is if you can prove that they've been neglectful in maintaining their tree. You may claim negligence if the tree has been dead on their property for ten years, but proving this to an insurance company can be difficult. No matter what, you would always file the claim with your insurance company.

What If the Neighbor Was Trimming a Branch from the Tree and It Fell on My Property?

If your neighbor is cleaning up their trees and does not take the precautionary steps to remove their branches safely, you're likely to have more of a case for why they should have to pay for the damage they caused.

You would still file the claim with your homeowners insurance, but your insurance would work with your neighbor's insurance to determine whose policy would pay for the damage.

Does Mississippi Car Insurance Fully Cover Damage to the Car?

If a Mississippi storm blew a tree into your yard that caused damage to your vehicle, you'd turn to your car insurance policy to help cover the repairs.

In this scenario, you would need to have comprehensive insurance coverage to be covered. Comprehensive coverage is an optional policy in Mississippi. Even though it's optional, comprehensive coverage helps pay for damage for anything other than a collision, so it's worth talking to your independent insurance agent about adding this policy to your car insurance.

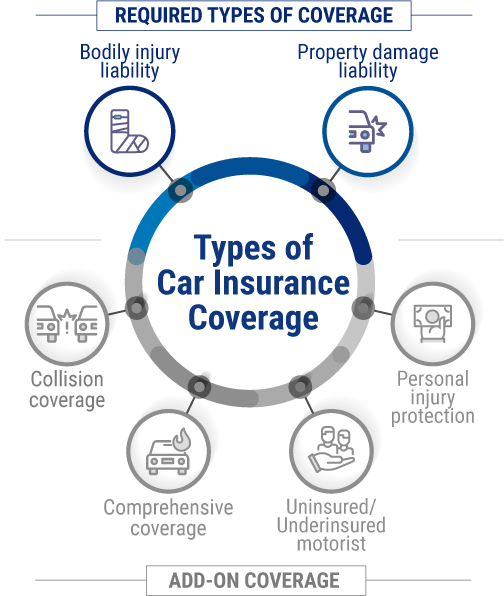

What Does Car Insurance Cover in Mississippi?

When purchasing Mississippi car insurance, you'll be required by law to purchase liability insurance, all other coverages are optional.

Required car insurance policies in Mississippi:

- Bodily injury liability: This helps pay for medical costs to other drivers and their passengers if you cause an accident. It will also pay for legal fees if you're sued.

- Property damage liability: This will reimburse others for any property damage that you cause using your vehicle.

Common add-on car insurance policies in Mississippi:

- Collision coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Uninsured motorist coverage: This coverage protects you if you get into an accident with a driver who does not carry any or enough car insurance to reimburse you adequately.

- Personal injury protection: This coverage pays for the driver’s injuries and injuries to their passengers after an accident.

If My Car Doesn’t Have Comprehensive Coverage, Can My Home Insurance Cover It?

Your Mississippi homeowners policy would not step in to cover vehicle damage in the event of a severe storm. You must carry auto insurance to receive coverage.

If you have no insurance on your vehicle or do not have the proper insurance, you can only make someone else pay if you can prove their acts caused the damage. This can be difficult to prove to insurance companies, so it's useful to consider full protection with comprehensive and collision coverage on your vehicle.

If the Tree Lands on My Home, How Does My Home Insurance Cover it?

Homeowners insurance is designed to cover all aspects of your home, from the structure to your stuff inside. To understand how your insurance would cover a storm, you first need to know what home insurance typically includes.

Basic home insurance coverages:

- Liability coverage: This coverage will help pay for any bodily injury or property damage claims made against you. This includes attorney and court fees, restitution costs, medical bills, and any other financial responsibilities you may have.

- Dwelling and contents coverage: These coverages are part of your property insurance that protects the structure of your home, including detached structures, in addition to all the stuff inside your home. Your policy will include a list of covered perils, including fire, storm, wind, hail, theft, vandalism, and others.

- Additional living expenses coverage: This reimburses any costs associated with having to temporarily live somewhere else after a covered disaster damages your home. It will pay everything from hotel costs to daily meals and additional gas mileage.

If a storm damaged your home, most of the damage would fall under your property damage coverage. Under this policy, you would receive removal of fallen trees and removal and cleanup of debris. Every policy has different stipulations for its coverage, so it is best to talk with your independent insurance agent to understand when you'll be covered.

Am I Responsible for Covering Any Damage Caused by My Neighbor’s Tree?

Technically, yes. Since the tree fell as the result of an "act of God," your insurance would cover the damage up to your policy limits. Having the right home and car insurance can ensure that you don't have to pay out of pocket when this happens.

You would also be responsible for paying your deductible before your insurance would step in.

How Can a Mississippi Independent Insurance Agent Help?

Storms are unexpected events that you cannot control the outcome of. You can control how you are prepared and make sure you have the best home and auto insurance to protect your most valuable assets. To find the best policy for you, you need a Mississippi independent insurance agent.

Agents work for you and will take the time to shop multiple quotes to find you the most affordable policy with the best protection. They can answer your questions and even help guide you through the claim process should you need it.

Article reviewed by | Jeffrey Green

https://www.iii.org/article/auto-insurance-basics-understanding-your-coverage

https://www.iii.org/article/homeowners-insurance-basics

https://www.iii.org/article/which-disasters-are-covered-by-homeowners-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.