When a disaster occurs, it can be devasting for you and your loved ones. There are numerous coverage options you'll have when it comes to insuring your assets. Mississippi homeowners insurance can help protect your property and your family with tornado insurance.

A Mississippi independent insurance agent will have access to numerous carriers so that you have options on policy and premium. Since they do the shopping for you at zero cost, you'll save both time and money. Connect with a local expert to get started today.

What Is Tornado Insurance?

In Mississippi, the right protection for your property could save you from significant financial distress. Without proper limits of coverage, you'll be on the hook for whatever comes. Check out how tornado insurance can help:

- Tornado insurance: This type of property insurance covers a structure for losses due to a storm. Tornadoes, hurricanes, severe winds, lightning, hail, and more can cause damage to your property.

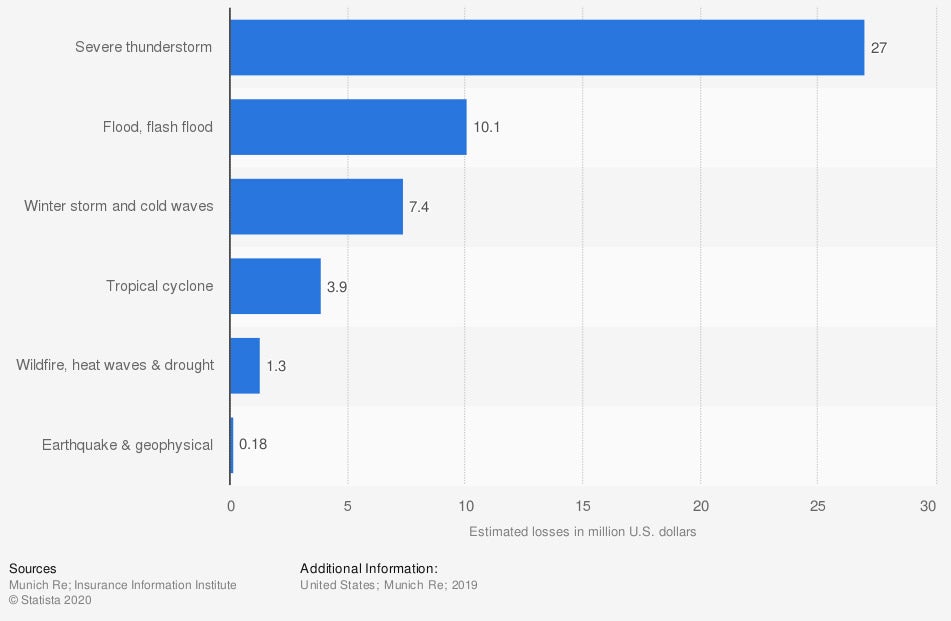

Estimated overall losses due to natural disasters in the US in one recent year, by type (in million US dollars)

You never know when a catastrophe will wipe out everything you hold dear. It's vital to understand how your policies protect you from loss.

What Does Tornado Insurance Cover in Mississippi?

Most property policies will have coverage against natural disasters. Your Mississippi personal or commercial property insurance will typically come standard with tornado coverage. Take a peek at what tornado protection will cover:

- Electrical and plumbing systems

- Foundational elements

- The structure itself

- Detached garages

- Well water tanks and pumps

- Personal belongings

What Doesn't Tornado Insurance Cover in Mississippi?

All insurance policies come with various exclusions. Some you can add back in, while for others, you're on your own. If you want insurance for a tornado, your home and property policies usually insure it. However, some items wouldn't fall under the tornado coverage.

Damage that's generally excluded from your home and property policies:

- Flooding: This needs a separate policy all on its own. There are FEMA-approved carriers your agent works with to get you the right coverage.

- Car damage: This will fall under your personal or commercial auto policy. Coverage for any physical damage to your vehicle due to a tornado loss must be preselected.

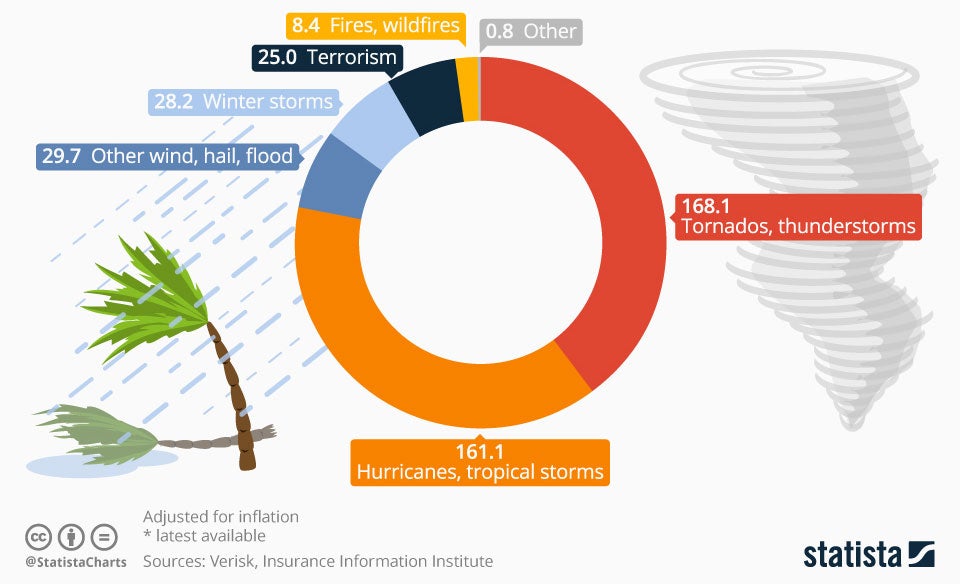

Tornadoes and hurricanes cause biggest disaster losses in the US

Tornadoes are quite common in the US, and having limits that match your risk exposure is necessary.

Does Car Insurance Cover Tornado Damage in Mississippi?

Physical damage to your vehicles in any form can be covered under your personal or commercial auto policies. Protection against tornado damage to your car can be found through comprehensive coverage. This limit will have to be added to your policy and will cost an additional premium.

Does Homeowners Insurance Cover Tornado Damage in Mississippi?

The short answer is yes. A standard homeowners policy will have coverage for a tornado loss up to the policy limits. Check out these four easy steps to file an insurance claim when tornado damage occurs:

- Step 1: Get to a safe place.

- Step 2: Call your independent insurance agent.

- Step 3: Obtain information through your agent about temporary housing and a replacement vehicle if applicable.

- Step 4: Set up a meeting with your assigned adjuster to go over the damage.

How Much Does Tornado Insurance Cost in Mississippi?

The price to insure your property against a tornado loss is already worked into your policies. Take a look at the average annual premiums for home and auto insurance below:

- National annual home insurance premium: $1,211

- Mississippi annual home insurance premium: $1,537

- National annual auto insurance premium: $1,311

- Mississippi annual auto insurance premium: $1,584

How an Independent Insurance Agent Can Help in Mississippi

When you're searching for the best protection in Mississippi, consider using a trained professional. Your home, auto, and business insurance policies will come with many coverage options, making it confusing. Fortunately, an adviser can review your policies for free so that you're fully insured.

A Mississippi independent insurance agent will have access to a network of markets, giving you the best coverage for an affordable price. They'll even compare several policies at no cost and present you with the most competitive option. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/216836/estimated-overall-losses-due-to-natural-disasters-in-the-united-states/

https://www.statista.com/chart/18226/loss-of-insured-property-through-disasters-us/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.