If you are starting a building project, you'll want coverage for the process. Mississippi business insurance can include a builders risk policy. To make sure you're obtaining the right protection, consider using a professional.

A Mississippi independent insurance agent can help with coverage and premium options. Since they work with several markets, you'll always get the best deal. Connect with a local expert for custom quotes in minutes.

What Is Builders Risk Insurance?

In Mississippi, a builders risk policy will supply coverage for all that goes into constructing a building. If a loss occurs during the process, this policy will provide coverage. Check out the risks that builders risk insurance will cover when projects are under construction:

- Fire

- Lightning

- Hail

- Theft

- Vandalism

- Acts of God, like tornadoes

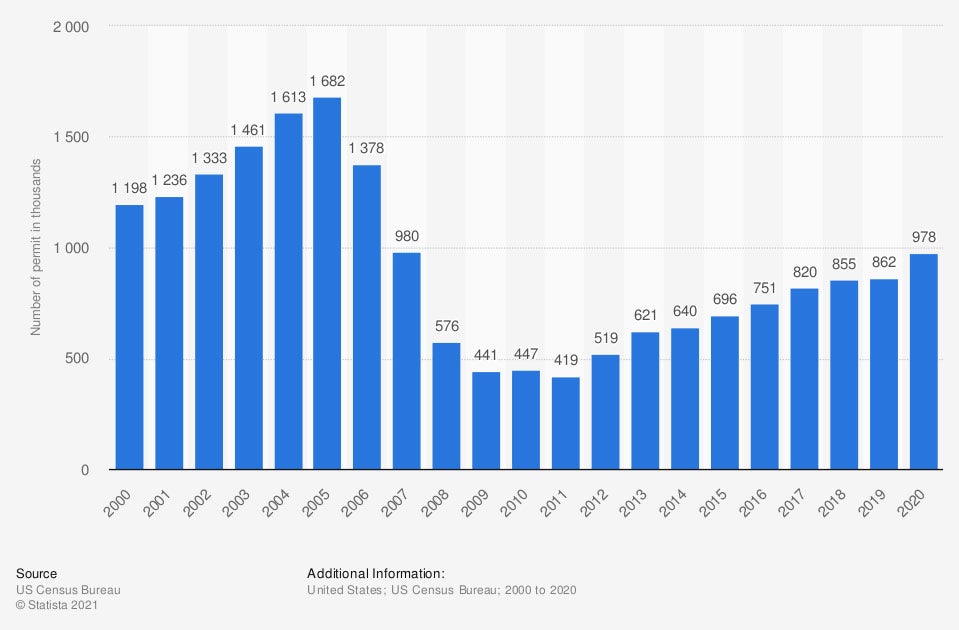

The number of single family building permits in the US (in thousands)

Building in the US is a way of life. If you're starting a residential project, the proper protection for a claim can make all the difference. A loss could cause a halt in production and delay or cancel your build-out altogether.

What Does Builders Risk Insurance Cover in Mississippi?

Many things can go wrong during the building process. It's essential to know what your policy will and won't cover. Mississippi builders risk pays for things like:

- Materials

- Equipment on site

- Equipment in transit

- Delays in project scope

- Loss of use

- Permits

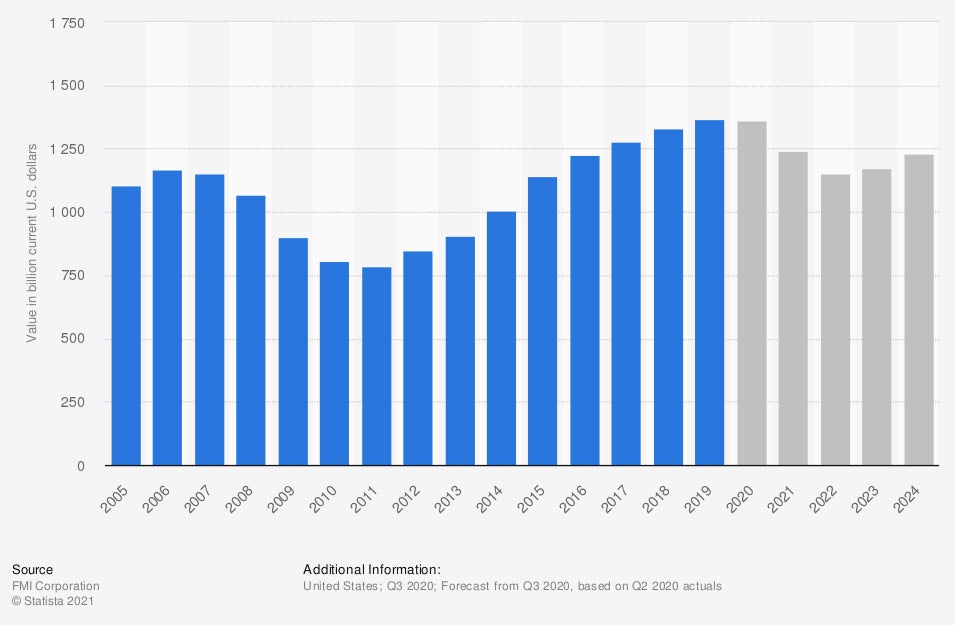

Value of new construction in the US (in billion US dollars)

The cost of building is never cheap. The best way to protect your assets is to be proactive with adequate coverage.

How Much Is Builders Risk Insurance?

All commercial insurance premiums will vary. Mississippi builders risk insurance costs will be individualized for each project. Carriers look for personal data and other elements when rating your policy. Take a look at what your builders risk insurance cost depends on:

- Type of project

- Details of the project

- Coverage selected

- Anticipated cost of completion

- Length of project

Who Is Responsible for Builders Risk Insurance in Mississippi?

When you own the property and hire a contractor to build out your project, coverage of some kind is necessary for both parties. Any general contractor you hire will have their own insurance coverage, which usually extends to each project they are working on. Anyone with a financial interest in the build-out should be listed on the builders risk policy. You are likely to want to list the following on your coverage:

- Subcontractors

- Lender

- General contractor

- Architect

Do I Need Builders Risk Insurance in Mississippi?

In Mississippi, $3,120,632,000 in commercial insurance claims were paid in 2019 alone. Your builders risk insurance policy can save your project if a loss occurs. Builders risk insurance is necessary when you are working on these things:

- A residential construction project

- A commercial construction project

- Remodeling your house

- Remodeling your commercial property

Does Builders Risk Insurance Cover Theft in Mississippi?

Theft and vandalism are some of the most common losses that can occur on a job site. It is not unheard of for contractors to leave equipment and materials out in the open while building. A Mississippi builders risk policy will cover your exposure to theft and vandalism if a claim arises. It can help pay for things like:

- Building materials

- Items left out on a job site

- Equipment

Builders Risk for Your Home in Mississippi

If you're building a new home or remodeling an old one, there are some things you need to know. In order to have proper protection, you'll want to have coverage for the process.

When you obtain a builders risk policy, it will help insure your home during the construction. If you are building a new home, the contractor usually holds the builders risk insurance. However, you may want to be listed as an additional insured on the policy when you have a financial interest in the process.

How to Connect with an Independent Agent in Mississippi

If you're looking for the perfect Mississippi policy for your project, consider using a licensed adviser. Insurance should be the first thing you purchase when starting a build-out. A builders risk policy can cover the construction from start to finish.

A Mississippi independent insurance agent will have access to several markets so that you can save. Since they do the shopping for you at no additional cost, you'll have options. Connect with a local expert on TrustedChoice to get quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/456883/number-of-single-family-building-permits-in-the-usa/

Graphic #2: https://www.statista.com/statistics/226368/projected-value-of-total-us-construction/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.