Mississippi has 2,990,468 residents, and some of them operate businesses. In one year, 44 fatal accidents were caused by commercial truck drivers in this state. Mississippi business insurance can help provide commercial auto coverage for adequate protection.

Fortunately, a Mississippi independent insurance agent can help with coverage and premium options that won't break the bank. They have a network of carriers so that you get the best policy for a fair price. Connect with a local expert for custom quotes today.

What Is Commercial Auto Insurance?

Commercial auto insurance will provide coverage for liability and property damage that occurs while operating vehicles for your business. Your risk is even greater if you have employees that utilize company vehicles as well. Mississippi commercial auto insurance is mandated by state law.

Is Commercial Auto Insurance in Mississippi Mandatory?

In Mississippi, it is required by state law to carry the minimum limits of liability for commercial auto insurance and personal insurance. If you are without coverage, you could be met with fines or worse. Check out the state's requirements below:

Mississippi's minimum liability requirements for commercial vehicles:

- $25,000 property damage liability per accident

- $50,000 bodily injury liability per accident

- $25,000 bodily injury liability per person

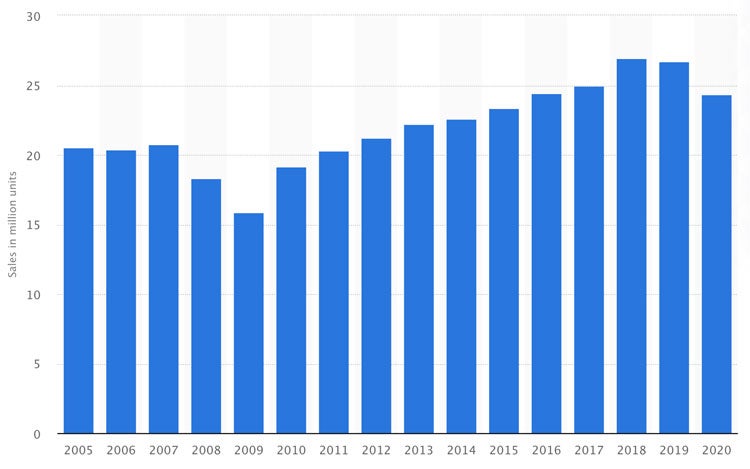

Commercial vehicle sales worldwide, 2005-2020 (in million units)

If you are in the business of hauling things, you'll want to add cargo coverage as well. The Department of Transportation (DOT) will classify each load based on the materials inside.

How Much Does Commercial Auto Insurance Cost in Mississippi?

The commercial auto insurance industry is a $46.6 billion market. Your costs will be a small part of that figure. Check out the risk factors that companies use to determine your Mississippi business auto insurance pricing below:

- Year, make, and model of all vehicles

- The radius in which you travel

- The number of drivers and their driving records

- The coverage you choose

- Where you store the vehicles

- What safety measures you have in place

What Does Commercial Auto Insurance Cover in Mississippi?

Mississippi commercial auto insurance will come with limits of liability automatically. However, if you want coverage for anything else, it will need to be added. Take a look at the optional coverage choices below:

- Towing and roadside assistance: This will pay for a tow to pick up your disabled commercial auto.

- Rental car insurance: This covers the cost of renting a commercial vehicle while your company-owned auto is being repaired.

- Uninsured motorist insurance: If your commercial auto is involved in an accident with an uninsured driver, this provides coverage for property damage and medical costs.

- Comprehensive insurance: This covers the cost to repair or replace your commercial vehicle if it is lost or damaged due to a non-collision accident.

- Collision insurance: This will replace or repair your commercial auto that is damaged due to an accident.

- Hired and non-owned auto liability insurance: If an employee or contractor uses a non-company-owned vehicle while doing business on your behalf, this will cover your exposure.

What Doesn't Commercial Auto Insurance Cover in Mississippi?

Mississippi commercial auto insurance will have a list of exclusions, just like any other policy you own. Check out what's not insured under commercial auto insurance:

- Non-scheduled vehicles: Unless your policy has bailee's coverage, you will not have insurance for customer vehicles not listed on the policy.

- Drive other car: If you are renting or driving another vehicle on company time and have an accident, you won't have coverage under your policy without the drive other car endorsement.

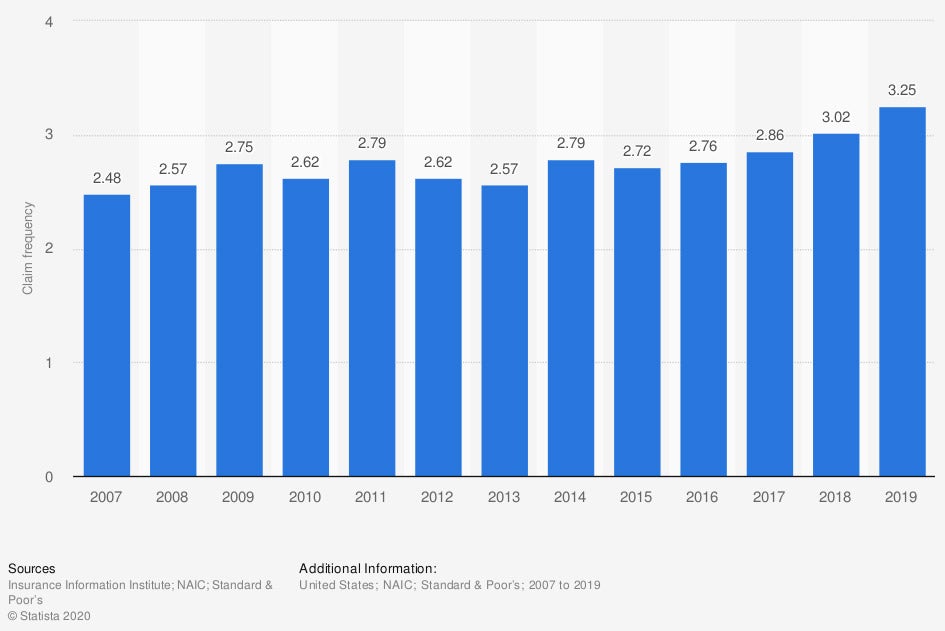

Frequency of private passenger comprehensive auto insurance claims in the United States from 2007 to 2019 (per 100 vehicles)

If you're found without adequate coverage, you could be out thousands of dollars in damage. Comprehensive insurance can help fill that gap when a loss occurs.

How a Mississippi Independent Insurance Agent Can Help You

Commercial auto insurance in Mississippi is vital for any business-owned autos. Whether you're hauling heavy loads or using it to drive around town, your commercial auto policy needs to be on point. Instead of looking for coverage on your own, consider using a trusted adviser.

A Mississippi independent insurance agent has access to multiple markets so that you're always getting the best coverage. Since they do the shopping for you at no extra cost, you'll save time and premium dollars. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/265902/worldwide-commercial-vehicle-sales/

Graphic #2: https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.