In Mississippi, $3,120,632,000 in commercial insurance claims were paid in 2019 alone. To have adequate protection for all the what-ifs, you'll want the right policies in place. Fortunately, Mississippi business insurance will have coverage for your grocery store.

A Mississippi independent insurance agent has access to several markets so that you can save time and premium dollars. They do the shopping for you at no additional cost, letting you relax. Connect with a local expert for tailored quotes in minutes.

What Is Grocery Store Insurance?

Mississippi grocery store insurance will help you pay for claims related to liability, property, and employees. Check out some common coverage choices for grocery stores below:

- General liability

- Business property

- Business inventory

- Workers' compensation

- Business auto

- Employment practices liability

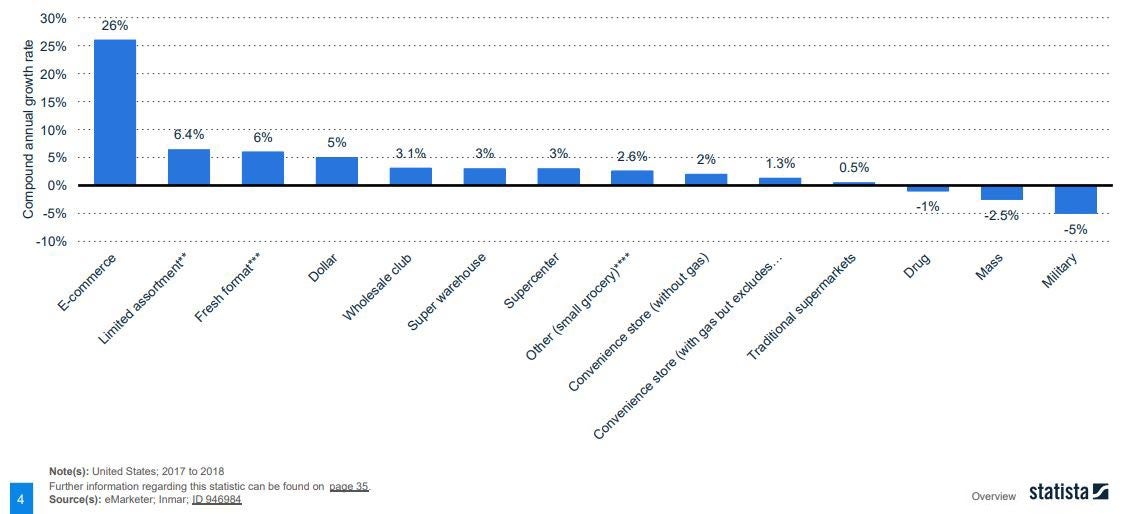

Compound annual growth rate of grocery stores in the US, by retailer type

Grocery stores in the US will probably stick around, and they have become an essential part of everyday life. It's crucial to know how your grocery store coverage works.

What Does Grocery Store Insurance Cover in Mississippi?

Mississippi has 257,404 small businesses in existence. Each will come with industry-specific coverage options. Let's look at common grocery store coverages:

- Coverage for claims of bodily injury or property damage

- Coverage for food and inventory spoilage

- Coverage for your business property that is damaged due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Below is a list of basic perils that you can expect to be insured under your grocery store policies:

- Fire

- Natural disasters

- Theft

- Vandalism

- Water damage (not from a direct flood loss)

How Much Is Grocery Store Insurance in Mississippi?

All commercial insurance policies will vary depending on the size, sales, and operations of the businesses. Your Mississippi grocery store insurance will be unique to your daily risks. Take a look at the factors companies consider when quoting:

- Loss history

- Replacement cost values

- Experience level

- Location

- Local crime rate

- Local weather patterns

Will My Location Impact My Rates in Mississippi?

Where your Mississippi grocery store is located does impact, not only your growth, but also your insurance costs. Carriers look at how safe your establishment is and where it is located. If you're in an area that's high in crime, or where natural disasters occur frequently, you can expect to pay more for protection.

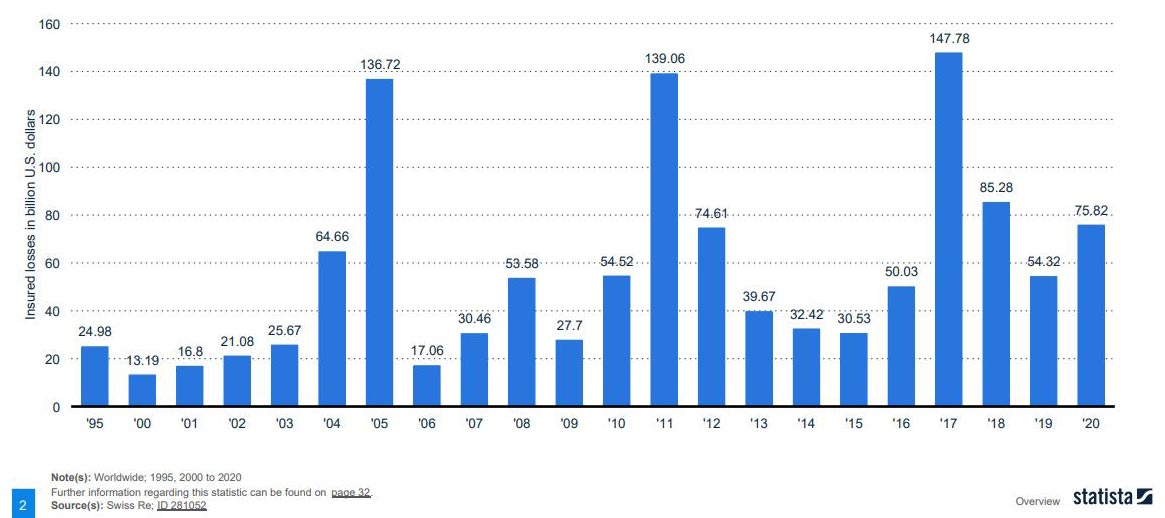

Insured losses by natural disasters worldwide from 1995 to 2020 (in billion US dollars)

If you are in a zone that is prone to flooding, that is another factor insurance companies look at when rating your coverage. A separate flood insurance policy will add more expense to your insurance costs if you have to add it to your roster.

How an Independent Insurance Agent Can Help in Mississippi

It may be challenging to know how much coverage is necessary if you're not a licensed adviser. There are several different policy options to choose from when you own a business. Grocery store insurance will come with a variety of options that can be reviewed with the help of a trusted professional.

Fortunately, a Mississippi independent insurance agent has access to a network of carriers so that you get the best policy for an affordable price. They'll even do the shopping for you at no additional cost, making it a no-brainer. Connect with a local expert on TrustedChoice for tailored protection in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/study/20820/us-consumers-online-grocery-shopping-statista-dossier/

Graphic #2: https://www.statista.com/study/11801/catastrophe-losses-of-the-insurance-industry-statista-dossier/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.