In Mississippi, $3,120,632,000 in commercial insurance claims were paid in 2019. As a company, you'll have to account for every exposure. Mississippi business insurance can help protect some of your assets with inland marine coverage.

A Mississippi independent insurance agent will have access to multiple markets so that you have options. They compare carriers and premiums for you at no additional cost. Get connected with a local expert for custom quotes in minutes.

What Is Inland Marine Insurance?

Inland marine insurance for your Mississippi business will help with property in transit. This policy is different from commercial property coverage, and you're likely to need both.

- Inland marine insurance: Replaces or repairs your business property when a covered loss occurs. This could be from heavy machinery to tools in transit. The items insured will depend on the policy and the carrier.

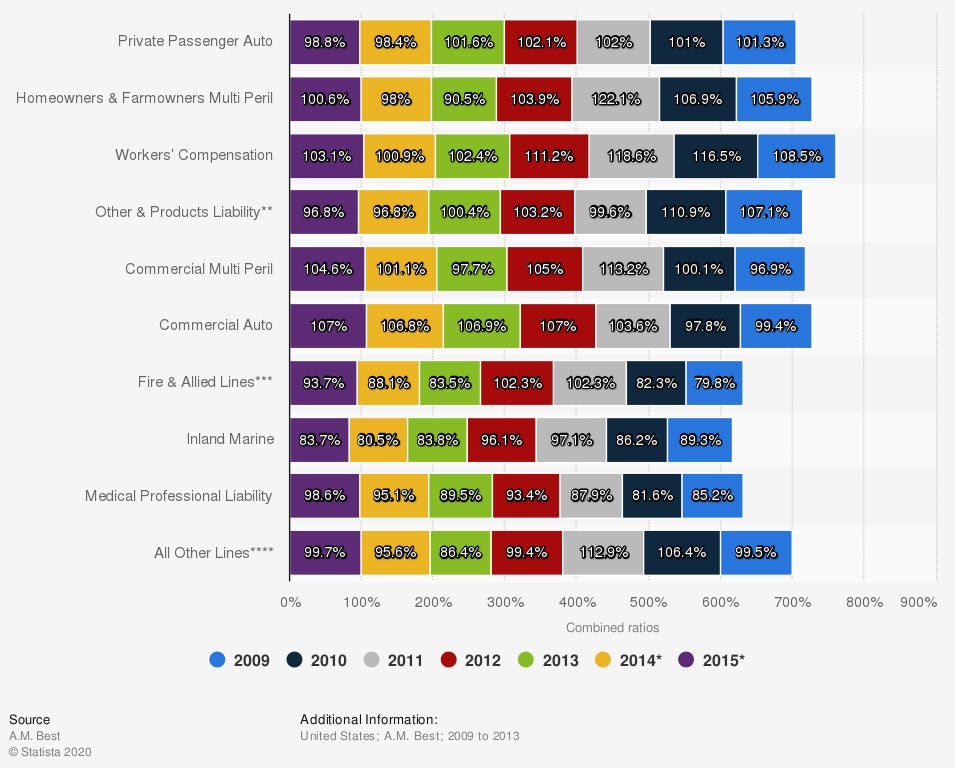

It's good to know how commonly used inland marine insurance could be for your operation. The ratios of inland marine insurance in the nation are below:

Combined US ratios of inland marine insurance, by product line

Every inland marine policy will have unique coverage limits. Your insurance will be specific to your business.

What Does Inland Marine Insurance Cover in Mississippi?

There is special inland marine coverage that will insure different business types depending on your industry. Some examples of these are as follows:

- Bailee's insurance: Used for client property that is left in the care, custody, and control of your business.

- Builders risk insurance: Used to protect the property and materials used when building a structure.

- Installation insurance: Used when items are in transit up until they are installed. Also known as in-transit coverage.

There are common risks that are covered under your Mississippi inland marine policy and come automatically. Most policies will have coverage for the following:

- Fire

- Wind

- Hail

- Theft

- Water damage

All carriers will have their own spin on coverage offerings. Some items that may not be included but can usually be added are as follows:

- Mysterious disappearance: Pays for missing property when the cause of loss can't be discovered.

- Accidental damage: Pays for the replacement or repair when an item is dropped. This can be in transit or when loading or unloading.

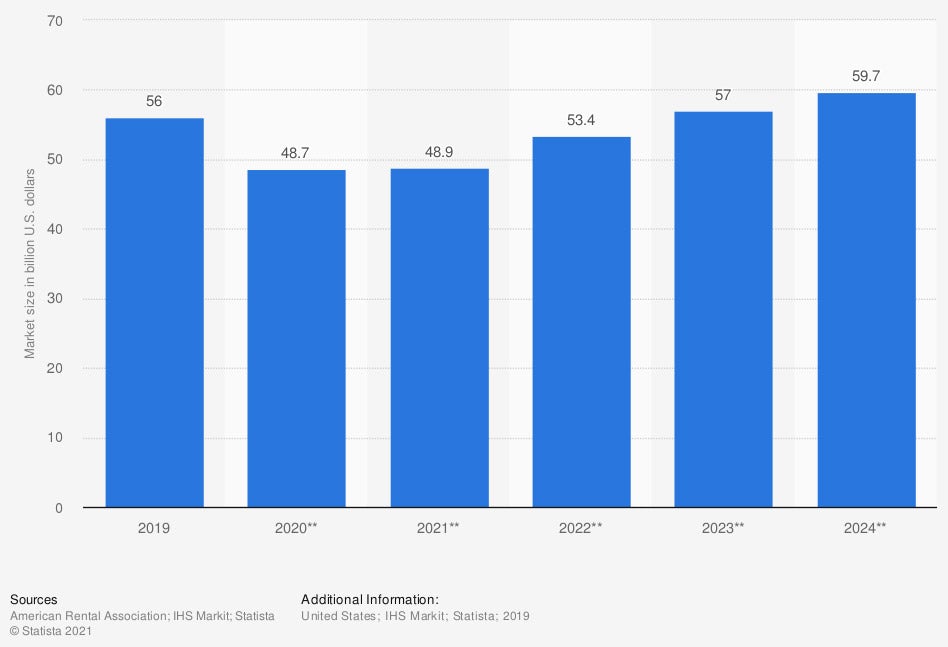

If you're in the business of renting property out, an inland marine policy is necessary. Take a look at the rental equipment market below:

US equipment rental market (in billion US dollars)

Things like contractor's tools, contractor's equipment, computer systems, sales equipment, and heavy machinery should be insured under this policy.

How Much Does Inland Marine Insurance Cost in Mississippi?

Insurance companies use your risk factors when quoting your inland marine policy. Your premiums will be unique to your business and equipment type. Take a look at what carriers use when determining the cost of Mississippi inland marine insurance:

- Value of items

- Prior claims

- Coverage limits

- Risk mitigation measures

- State claims records

Does Inland Marine Insurance Cover Theft in Mississippi?

Fortunately, your Mississippi inland marine policy will come standard with theft and vandalism coverage. Property and equipment that you have in transit or at a location can add up to hundreds of thousands of dollars. If you have an incident where property is stolen or damaged, you will have coverage under your inland marine policy, minus your deductibles.

Personal Inland Marine Insurance in Mississippi

Your Mississippi homeowners insurance will typically have an area where you can schedule your personal items. This is known as a personal inland marine policy or a personal articles floater. You'll list your high-value items under this policy for appraised amounts. See what's usually listed under this policy type:

- Furs

- Guns

- Artwork

- Jewelry

- Golf clubs

- Musical instruments

How to Find a Mississippi Independent Insurance Agent

When you need the right Mississippi business insurance, there can be a lot of options. A licensed professional can help you find the proper coverage. They will do the shopping at no additional cost to your company so that you can focus on your business.

A Mississippi independent insurance agent has access to several carriers, saving you time and money. They do all the work and present you with the best policy choices. Connect with a local expert on TrustedChoice for tailored protection in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/437171/combined-ratios-pc-insurance-usa-by-product-line/

Graphic #2: https://www.statista.com/statistics/248725/us-equipment-rental-market-size/

http://www.city-data.com/city/Mississippi.html

© 2026, Consumer Agent Portal, LLC. All rights reserved.