Mississippi has 257,404 small businesses in existence. As a company, you're responsible for having adequate protection. Mississippi business insurance will have liability coverage.

A Mississippi independent insurance agent can review your policies for free, so you know you're getting sufficient coverage. They'll even do the shopping for you at no additional cost. Connect with a local expert to get started in minutes.

What Is Liability Insurance Coverage?

Your Mississippi liability insurance can come in several different forms. The industry you are in and the exposures you have will determine what types are necessary. In essence, all liability policies will have the same foundational coverages:

- Liability insurance: Will pay for a lawsuit arising out of bodily injury, property damage, or slander. It can be obtained for business and personal use.

What Is Commercial General Liability Insurance?

One of your primary policies for your Mississippi operation will be commercial general liability insurance. Multiple claims could be covered under this policy type, and limits should be reviewed for accuracy. Some claims where general liability coverage could apply are:

- A customer slips and falls on the premises.

- A building catches on fire.

- A product is improperly installed, causing a water loss.

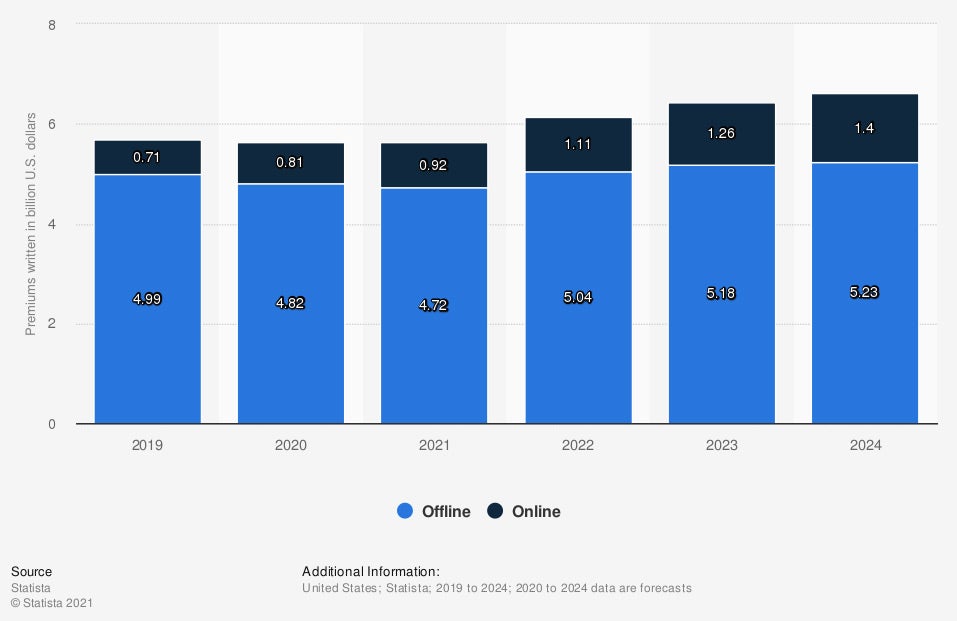

Value of business to consumer general liability insurance premiums in the US (in billion US dollars)

General liability insurance is a common policy for most businesses to obtain. If you do work for anyone else, they are likely to require proof of general liability in some form.

What Is Professional Liability Insurance in Mississippi?

If you're in the business of advising, you'll want professional liability insurance. This policy protects your Mississippi business from lawsuits arising out of negligence or misinformation. Some industries where professional liability applies in Mississippi are as follows:

- Accountant

- Lawyer

- Real Estate agent

- Insurance agent

- Financial adviser

- Business broker

What Is Employment Practices Liability Insurance Coverage in Mississippi?

If you have employees in Mississippi, you'll have options on different liability policies that pertain to staff members. Employment practices liability insurance will cover your risk when an employee files a lawsuit against your business. Check out what it covers:

- Employment practices liability insurance or EPLI: Pays for a lawsuit filed by a disgruntled employee due to discrimination or sexual harassment in some form.

What Is Liability Coverage on Home Insurance in Mississippi?

In Mississippi, your home policy comes standard with a limit of liability protection. You'll be able to choose your limit based on how much coverage you want. Take a look at some instances where liability protection could apply:

- A guest or trespasser injures themselves on your property.

- Your tree falls and damages your neighbor's roof.

- You have a pool party, and a guest drowns.

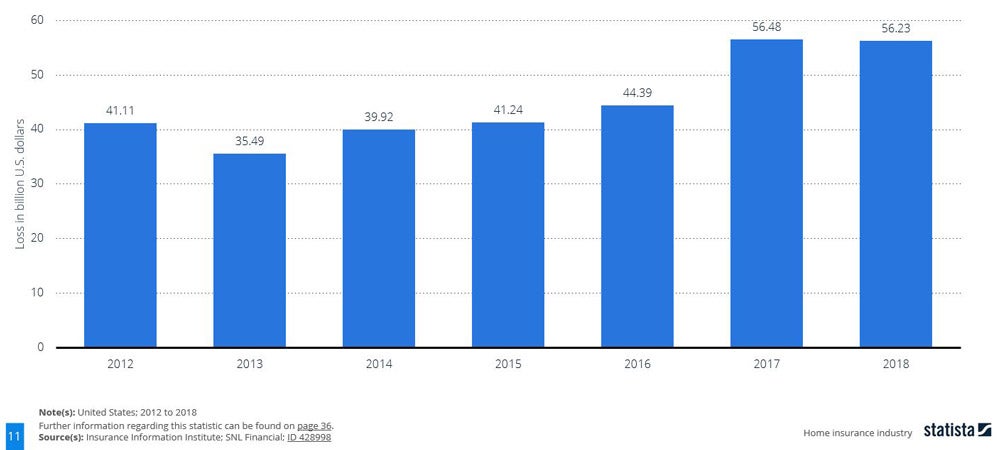

Incurred homeowners insurance losses in the US (in billion US dollars)

Home insurance claims happen every day, no matter where you live. It's essential to have adequate coverage for all life throws your way.

What's the Difference between Full Coverage and Liability Insurance in Mississippi?

Typically, full coverage refers to your commercial auto policy. Your commercial auto insurance will come with the minimum limits of liability only. If you want protection for anything else, you'll have to add it. Take a look at the difference:

- Liability only insurance: This is just liability coverage at the amount preselected for your auto policy. It will pay for bodily injury per person, per accident, and property damage of another party.

- Full coverage insurance: This will include additional coverages that protect you on the road. Things like comprehensive, collision, towing, and more are among the optional coverages you can select.

How a Mississippi Independent Insurance Agent Can Help

If you're looking for commercial insurance that fits your needs and budget, consider using a licensed professional. You'll have several policy options to choose from when it comes to your business coverage. Mississippi liability insurance is your primary policy and usually the first one you obtain.

Fortunately, a Mississippi independent insurance agent can help with coverage and premiums that are affordable. They do the shopping for you at no additional cost so that you can relax. Connect with a local expert on TrustedChoice to get started in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1119019/value-b2c-liability-insurance-premiums-written-usa/

Graphic #2: https://www.statista.com/study/41748/homeowners-insurance-in-the-united-states/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.