The average funeral cost in the US is $7,640, not including cemetery fees. For Mississippi residents, just a cremation service will run you around $3,500. Unfortunately, dying can be expensive, which is why life insurance is smart coverage to have.

Whether you're young and just starting a family or doing end-of-life planning, a Mississippi independent insurance agent can help you shop life insurance policies. Here's why life insurance may benefit you and your family.

What Is Life Insurance?

Life insurance is a contract between you and an insurance company where you pay a monthly premium in order for a person you selected (called a beneficiary) to receive a payout in the event that you die.

Typically, life insurance is designed to provide protection against the financial effects your loved ones may experience after an unexpected or untimely death.

Distribution of the 10 leading causes of death in the United States in 2019

Heart disease is currently the leading cause of death in the United States, accounting for 23% of all deaths. Other leading causes of death include cancer, accidents, chronic lower respiratory diseases, and cerebrovascular diseases.

What Does Life Insurance Cover in Mississippi?

While it may seem like life insurance is only designed to cover death-related expenses, the policy can pay for much more than that. Your beneficiary can use the death benefit to pay for any number of their expenses. However, the most common uses are for:

- Funeral costs

- Burial costs

- Help to replace lost wages

- A mortgage

- College tuition

- Everyday bills and expenses

There are no limitations on what your beneficiary can spend the death benefit on, but life insurance may not always pay out.

Most life insurance policies will have a suicide clause that states that it will not pay out in the event that the policyholder commits suicide within two years of purchasing the policy. They also will not pay out if the death is the result of fraudulent or illegal activities.

What is Mississippi Whole Life vs. Term Life Insurance?

According to insurance expert, Paul Martin, different life insurance policies make sense for different people depending on what stage they're at in their life. For this reason, there are multiple policy options to choose from, and the two most common are whole life and term life insurance.

- Whole life insurance: Also referred to as "permanent" life insurance, whole life is a contract you sign that lasts your entire life, until you die. It also includes a savings account that can accrue cash.

- Term life insurance: Covers you for a specific amount of time, typically 10, 20, or 30 years. When your term is up, you can choose to renew, increase, or switch to a whole life policy.

Each policy has its pros and cons. Take a look at a basic comparison of the two types of policies.

What Is Universal Life Insurance?

Another life insurance option available to Mississippi residents is universal life insurance. This policy is also a permanent insurance option, meaning it lasts the entirety of your life. It also builds cash value similar to a whole life insurance policy.

The main difference between whole and universal insurance is that you can adjust your death benefit and the premium of your universal policy.

You can choose to pay extra towards your premium and the extra money goes directly into your cash value and can even be used to pay for your premiums.

If you decide you want to increase or lower your death benefit, you can do that as well with a universal life insurance policy.

How Much Does Mississippi Life Insurance Cost?

Life insurance varies state by state and for each person. Your premiums will be impacted by a variety of factors, which makes it nearly impossible to put an average price tag on a policy.

The following will impact your life insurance premiums:

- Type of policy

- Age and gender

- Health

- Smoking

- Lifestyle

- Medical history, including family history

- Term length

While you can't control all of these factors, in general, the healthier you are, the more affordable your policy will be. The good news is that life insurance can be fairly inexpensive, starting around $10/month for some individuals.

What Are Some of the Risks That Can Affect My Rates?

Depending on your lifestyle and medical history you may be considered high-risk for a life insurance policy. This means that your risk of dying is higher than the predefined level of risk for insurance companies.

Some of the risks that can increase your life insurance premiums in Mississippi include:

- Smoking: Smoking is linked to several fatal diseases, making you a higher risk for insurance companies. If you purchase your policy as a smoker and later quit, you can call your carrier to adjust your premiums.

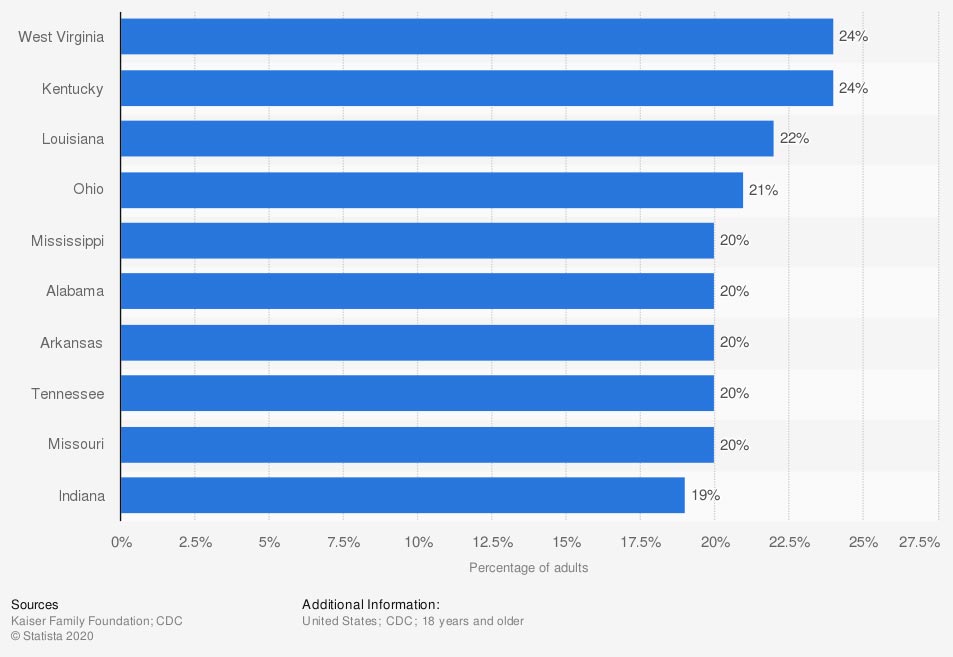

US states with the highest smoking rates among adults in 2019

Mississippi has the fifth-highest smoking rate in the United States. In Mississippi, 20% of all adults are smokers.

- Obesity: Being overweight is also linked to a number of illnesses and diseases that could cause an insurance company to believe you're a high-risk customer.

- Dangerous hobbies: If you enjoy skydiving and cliff-jumping, an insurance company will assume you're more at risk of dying than someone whose hobby is playing pickleball.

- Dangerous job: Even your job can impact your life insurance premiums. If you're in a high-risk career, it could negatively impact your insurance rates.

Your Mississippi independent insurance agent can help you understand the different risks that may impact your insurance premiums. They will also work with you to get the most affordable rates possible.

How Can a Mississippi Independent Insurance Agent Help?

"No one likes to think about the day they will die," said Martin. "Independent agents have the ability to help take the emotions out of it. They take the convolution out of it and will sit down with you and say it's money and we're just calculating finances."

If you're considering a life insurance policy, a Mississippi independent insurance agent is an expert that knows the best policy writers in Mississippi. They'll make sure you and your family are financially set for life and beyond.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.us-funerals.com/funeral-guide/mississippi/#.YJ8BVHdKjlw

http://www.mid.ms.gov/consumers/life-insurance-annuities.aspx#ittc

https://www.cdc.gov/nchs/data/databriefs/db395-H.pdf

© 2025, Consumer Agent Portal, LLC. All rights reserved.