If you run an operation, there are many moving parts. The proper protection is essential when covering your livelihood. Mississippi business insurance can provide coverage for your software company.

A Mississippi independent insurance agent has access to multiple markets so that you can save. They can help you review and shop policies that won't break the bank. Get connected with a local expert in minutes.

What Is Software Company Insurance?

Coverage for your software company in Mississippi will come in many forms. From insuring your commercial property to various liability coverages, you'll need multiple policies. Check out some common coverage choices for software companies below.

- General liability

- Business property

- Cyber liability

- Business equipment breakdown

- Commercial umbrella liability

- Workers' compensation

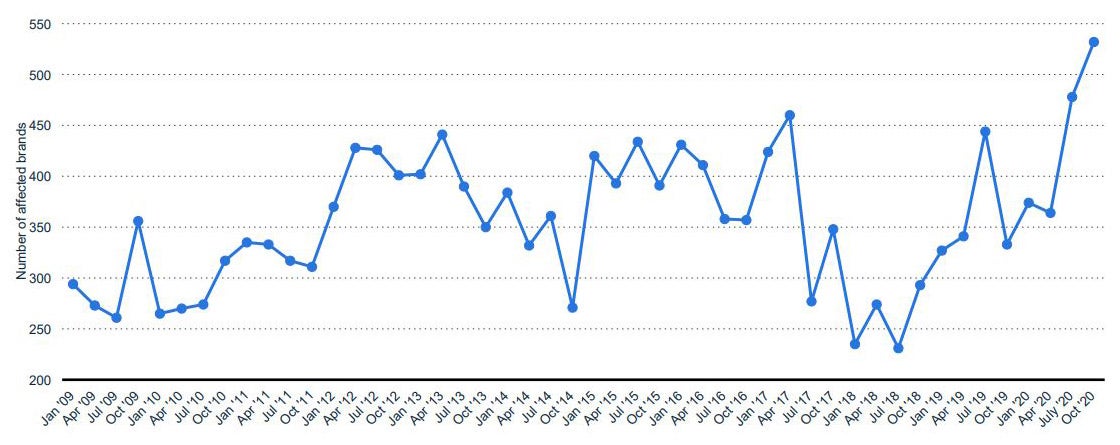

Cyber Targeting in the US

If you own a software company, your number one risk will be cyberattacks. To have adequate protection, you'll need a cyber liability policy.

What Does Software Company Insurance Cover in Mississippi?

Mississippi has 257,404 small businesses in existence. Software company insurance will have a unique set of needs. Let's look at common software company coverages.

- Coverage for bodily injury or property damage claim

- Coverage for your business property that is damaged due to a covered loss

- Coverage for a cyberattack

- Coverage for employees who become injured or ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees who sue due to discrimination or harassment

Your Mississippi insurance will typically come with protection against the below perils automatically.

- Fire

- Natural disasters

- Theft

- Vandalism

- Water damage (not from a direct flood loss)

How Much Does Software Company Insurance Cost in Mississippi?

In 2019, Mississippi had $3,120,632,000 in commercial insurance claims paid alone. Carriers look at various risk factors when quoting your coverage. Take a look at the criteria companies use when quoting.

- Loss history

- Replacement cost values

- Insurance score

- Malware used

- Location

- Local crime rate

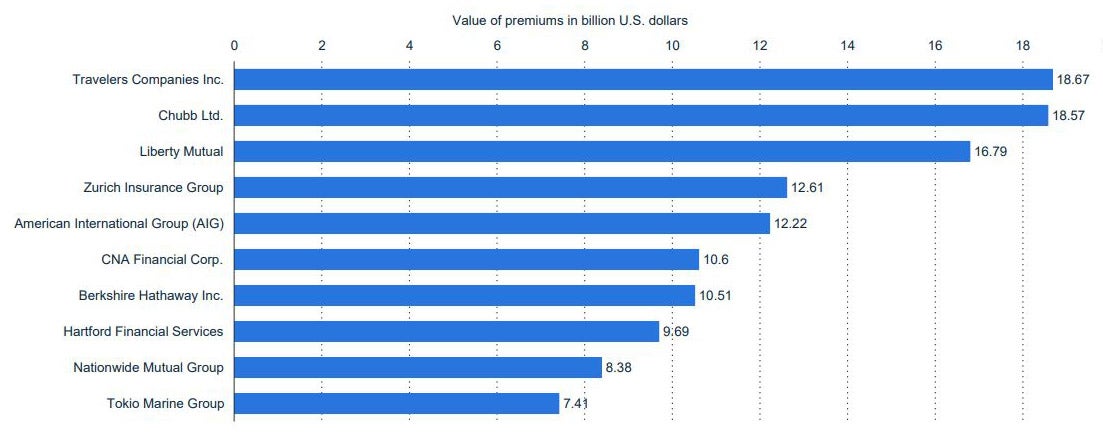

Leading Carriers for Commercial Insurance in the US

Your business insurance can come from many different sources. Some of the most used by annualized premiums are in the above chart.

What Does Software Company Insurance Not Cover in Mississippi?

Your Mississippi software company insurance will have coverage for a lot of items. Every policy will have things that aren't included or have to be added separately. Take a look at standard exclusions on your primary policies.

- Spoilage: This coverage refers to food or items that spoiled due to an equipment loss. It can usually be added for a fee, but won't be automatic in most cases.

- Vehicles: Some insureds think automobiles or company vehicles fall under business equipment, but they don't.

- Structures: If you want coverage for any structures or similar, it will fall under your business property coverage.

- Employee vehicles: If your employees use personal cars to drive to job sites, then they will need to have adequate coverage on their policy.

- Cyber liability: This is a separate policy most of the time and will need to be obtained on its own policy form.

- Flooding: Flood insurance is a stand-alone policy that can be purchased from FEMA-approved carriers.

Benefits of Software Company Insurance in Mississippi

Mississippi has approximately 2,999,468 residents who occupy the state. While more people can mean more clients, it can also lead to more risk. Anyone can file a lawsuit against your business. Adequate protection is necessary if you want to avoid out-of-pocket costs or worse.

How an Independent Insurance Agent Can Help in Mississippi

If you're looking for Mississippi business coverage for your software company, consider using a trained professional. It can be challenging to know what's necessary for your operation. You'll want to make sure you have proper coverage for your daily exposures.

A Mississippi independent insurance agent can help with policy and premium options. They do the shopping on your behalf at zero cost to you, saving time. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/study/12881/smb-and-cyber-crime-in-the-united-states-statista-dossier/

Graphic #2: https://www.statista.com/study/33205/property-and-casualty-insurance-in-the-united-states-statista-dossier/

http://www.city-data.com/city/Mississippi.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.